(archive reupload) letters collection #1-3

Reuploading and returning to writing.

I found that, though my miss rate was still quite high in this writing period, my slugging percentage was enormous. Theres some positive magic when you force yourself to try and write thoughts at the cutting edge. The clarity gained is still valuable, maybe moreso than ever. The LLMs cant quite think, gestate, and act in markets with sufficient reliability quite yet.

That said, writing publicly was hugely double edged. It’s no fun when things go awry with particularly the agents thesis obviously dead wrong in the end.

Incorrect thesis, short term correct results. It has happened many a time in crypto markets, with manic prices confusing many a crypto operator.

On the flipside, its cool to see the beginning of longtail thesis like META playing out. It was unimaginable for most to think 50% of major Solana protocols would use futarchy in Q4 24. Not so unimaginable a future in Q4 25.

Anyways, writing is valuable for me and constructive for others. I’ll prob do joint posts on substack + x articles moving forward. May we all grow together, and to those of us engaging in PvP internet monetary games, may we compete at the highest level.

Gl.

kelxyz // letters to the market #1 // september 2024

“Which is more important: getting, or letting go?”

My goal here is to increase my clarity of thought by writing, reviewing, and hopefully sparking discussion using these letters.

I wrote different parts of this at different times, sometimes while in twitter mode, sometimes in researcher mode, so please excuse my flexibility with respect to grammatical and capitalization-correctness. With that:

market view

The future remains uncertain. The best we can do is to understand and react to the present.

It’s undeniable we’ve seen bubble-level mania in many assets across crypto markets (albeit not to 2021 levels).

We’ve now seen declining hope, volume and activity across the board on the back of 6 months of poor price action, especially for alts.

Given the above, I’ve adopted a pseudo-defensive portfolio structure for the past few months, with way more cash than normal for me.

On the other side of that I have a number of high risk, high upside positions that each have a unique case for exponential outperformance should a second bull leg come to pass.

This portfolio construction offers some protection if alts continue down, perhaps on the back of a continued BTC downtrend (the echo bubble has topped view), while also offering exponential upside potential should alt markets recover (an extension of giver’s ethical long view).

I don’t know what will happen, there’s a range of outcomes. If either scenario looks increasingly likely, I can just adjust with speed. Agility matters

Everyone on CT tends to obsess over maximally hitting every move perfectly.

Of all the 9-10-11 figure investors I’ve studied, I’ve yet to see the ones who got there on the back of their 100% hit rate.

revisiting the memecoin supercycle

Attention dilution fueled by Pump Fun led to a mass dispersion of capital rather than a concentration into a few names.

What I initially characterized as “the next L1 trade” was better described as “the next ICO trade”.

The best memes did 100x+, but it was mostly memes doing it over and over, rather than the larger memes moving to 10b+ valuations as I had originally thought. As a result, the positions I initially selected as best were – incredulously – not far out enough on the risk curve. The biggest performers since Mar. 1 include Brett, Popcat, Boden, and Giga. All assets that traded around 10m MC or below (or didn’t exist) on March 1st.

There are two views to memes moving forward that feel relevant: the cabal pvp view, and what I’ve called the “world shock” view. I oscillate on where I stand regularly.

Cabal pvp

The cabal pvp view of memes argues that the true inflow into the meme market was much more muted than thought during and immediately post the march mania. Instead, small insider groups use methods like supply control and hype generation to pump these memes to storied valuations.

It’s without a doubt a ton of that has taken place in 2024. The financial incentive and perceived ability to get away with it for a lot of these people is too high for that not to occur. As the market realized this, the success of memes underwent euthanasia, with each subsequent “play” achieving lower and lower peak market capitalizations.

The million dollar question is: how do we get from cabal pvp to world shock pve?

world shock pve

The “world shock” case for memes refers to a number of hindsiightedly-idiotic posts i made referring to a second leg of the memecoin cycle which far outstrips what Q2 2024 was able to achieve. after muddling with the idea in a twitter-distant state for a while, I came to the seemingly-obvious conclusion that crypto must either become cool or seem economically vital for this “world shock leg” to commence.

The cool part is the more obvious hypothetical, if gambling on cat coins becomes the soup du jour with the people of real influence (in 2024, not people who had influence when I was 12) then we may expect large inflows of capital to gamble on crypto coins once more.

less evident to me was the “crypto becomes economically vital” investment thesis for memes.

i’ve been singing the praises of goodalexander’s Agentic Protocols report.

It will probably go down – alongside the similarly named Fat Protocols thesis – as one of the great hall-of-fame bullposts of the crypto era.

Core to his thesis is a world in which the “crypto x ai” vision actually bears fruit in the form of self sovereign AI agent protocols which engage in economic activity on or off chain, returning the value generated to the protocol token.

It’s easy to see a bonanza of a “new era” bull market in agentic protocols occuring in a world in which LLMs are about to John Wick the entire knowledge work economic apparatus.

What I’m proposing is that a potential corollary of an agentic protocols bull run would be a massive bullmarket in meme investment.

The financial nihilism displayed by cryptonatives in 2024 was a test run – for the nihilism displayed by the almost-riche of the entire world in 2025, 2026, and onwards.

It’s true that there will be many who see their industries and careers revolutionized at best or eliminated at worst and, in turn, try to invest in the new era, bidding goodalexanders agentic bags to gajillions.

This thesis argues that many, many others will turn away from the system entirely, accepting the nihilistic view in which humans have no economic value in the new era.

In that world, humans are not much more than a circus act, a joke.

Maybe even a meme.

In between the idealistic post-scarcity of Trekonomics, and where we are today, there is a gap. I don’t know if humans ever achieve Star Trek economics. I do feel intrigued by:

the likelihood markets overreact to the upside in response to the very legitimate worldwide change brought by ai (agentic protocols thesis)

the downstream likelihood that millions upon millions of people will reject this system of investment for whatever reason (nihilism thesis)

and finally, the likelihood that those same people will just dance in the rain, shocked into speculating on whatever they – and the influencers who lead them – find most amusing in what they perceive to be their final days (the world shock thesis)

Let’s see.

mental concepts

these are the concepts, mental models, market frameworks, etc. that im keeping top of mind lately. writing about them as I believe it will help me cultivate a psychological edge. sharing my writing so that hopefully it helps you too

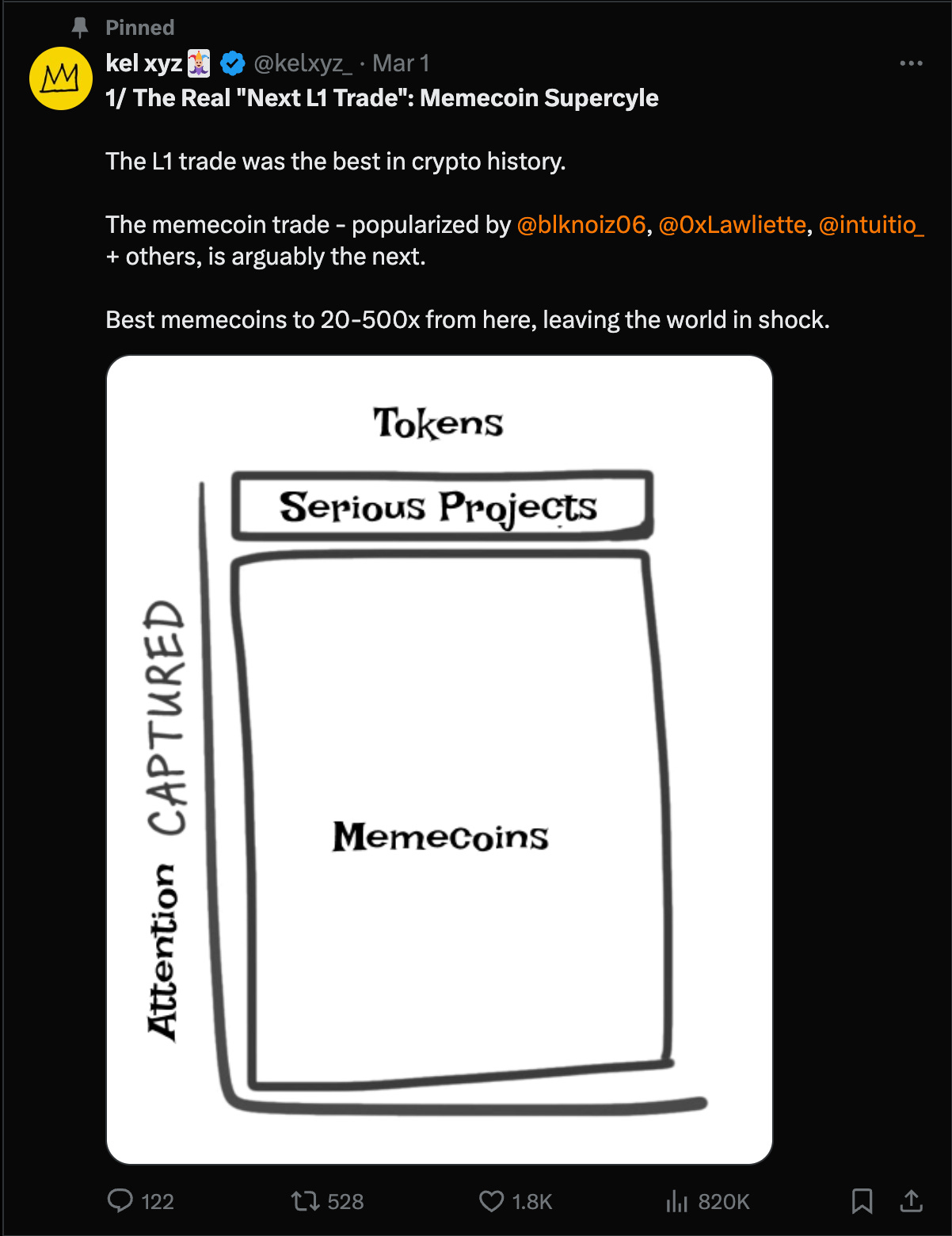

active share

active share (h/t @connorking_) at a high level describes the percentage of your portfolio that is outside the consensus index.

For example, it’s mostly consensus to hold BTC, ETH, and despite what people say, SOL. it is not consensus to hold a material amount of one’s portfolio in, say, BSV.

in this example, SOL would be considered a low active share position, while BSV would be considered high active share.

the above example highlights an important point: active share doesn’t automatically make a position a good one. I hold a decent amount of SOL and, shockingly, no BSV.

active share is important if one’s goal is to outperform markets. if you hold all the same coins that CT holds, why expect a result different than the average CT market participant? consider all the best traders and investors of crypto’s past.

they all had very high active share relative to their peer group – all in bitcoin early on while most were in stocks, all in eth when it was just a double digit shitcoin, all in defi when all erc20s were scam, max bidding solana at the “Lisbon Lows”. The list goes on.

there are two further reasons why I believe embracing active share is important specifically in crypto markets, especially today:

when crypto is in a bear market, all positions consensus or otherwise typically go down a lot. so why bother with the muted upside of consensus positions, unless you have no other choice (due to mandate/size/tax/lack of conviction in alternatives constraints)

In the part of the probability distribution that assumes we are mid cycle, positions with high active share drastically outperform, at least historically. Mid last cycle, Eth + Eth Defi were consensus, yet drastic outperformance came from buying Punks, Avax/Fantom Defi, Luna, Ohm, Axie, Metaverse tokens, or Art Blocks, not to mention the famed Alt L1 trade. Expressing a thesis on ANY of these in Q1 2021 would’ve gotten you laughed out of the room, yet by the November top it would be you laughing to the bank.

As such, while I still hold some portion of my portfolio in consensus names, namely Solana, active share has become a top guiding principle for my portfolio construction.

The two biggest risks to the active share approach are:

index outperforms, and

active share positions that aren’t yours outperform

For the first, it is possible that a market regime shift towards concentration in consensus names occurs, echoing the dominance of the “Magnificent Seven” of tradfi. This would mean SOL, BTC, maybe WIF etc grind upwards, but no downstream wealth effect occurs, and no new subsectors take off. This has never really happened in crypto to date, but would require significant portfolio adjustment on my part should this look to be the case.

In the second case, it means a broad rally or even bubble occurs in non-consensus markets, but they aren’t the one(s) I’ve selected. People who were bullish the wrong alt L1s, or the wrong Alt-Defi, or bought Hashmasks instead of Bored Apes fit this description. It’s a tough spot to be in, and arguably the most psychologically painful spot to bear.

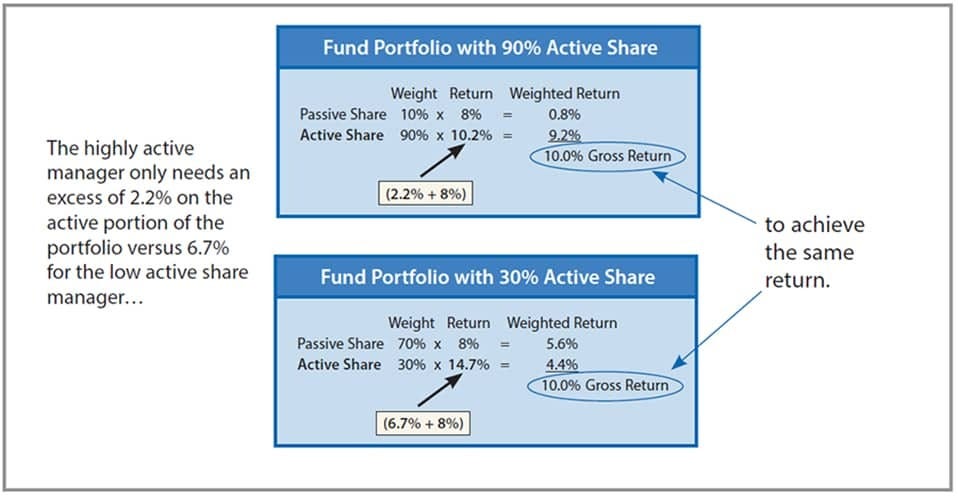

asymmetric risk & asymmetric return

It’s as Soros said - all that matters is how much is made when correct versus how much is lost when incorrect. Much is made of asymmetric return profiles, where 1-2 order of magnitude jumps in position size can be had. Fiskantes pointed out in a tweet I couldn’t find that more attention needs to be directed towards asymmetric risks.

Holding all your cash in one stablecoin presents asymmetric risk. No matter the perceived safety, the fact is you gain nothing by not diversifying and are subject to blowout risk in the worse case. The same goes for all types of concentrated positions.

These positions are not limited to financial ones. One wallet software, one hardware wallet provider, one browser, one exchange, and more all present asymmetric risks.

Eliminating these risks, however silly it seems today, is paramount.

inversion

Charlie Munger popularized – at least from my point of view – the idea that one may start from the desired end state and work their way backwards to the actions needed today. These actions are both “What must be true if I reached my end goal”, and also “What actions likely did not get me to my end goal?”

Many in crypto violate this principle on a day to day basis. I’ve been more than guilty of it too.

For example, most people say, “I want to make a gajillion dollars investing in crypto, buy 5000 acres of land in Italy, and reinvogorate the Roman Empire” or whatever.

But then, when you talk to people on any given day, their behavior exhibits a near-manic obsession over what seems to be the random trivialities of the day.

The price movement that already happened yesterday. The bit of breaking news that doesn’t change anything in almost every case. Pump fun, is it just or unnjust? Nomenclature of tech that neither they nor none of their investments are affected by.

The list goes on.

But if I asked these people, say you made a bajillion dollars. How would it have happened?

The story likely doesn’t begin with, “So I was trading the 15 minute chart in a Telegram group chat…”

Again, I’ve lost focus like this time and time again, you can just look at my twitter during various periods for proof of that. I’m just redialing my focus on the goals I have in sight, and trying to make sure my actions today are in line with those goals.

That’s partly why I’ve written this post - clarity and concision are gained through writing.

position evaluation framework + highlight

the basic framework for position building tries to align a high outlook for the fundamentals, technicals, and the market tone + reflexive potential surrounding the investment. When these are in line, the odds are skewed moreso in my favor.

Solana in Q1 2023 was the perfect example of this :

Fundamentals: Solana was market-leading tech back then, with a clear route to 10-100xing performance, with a resilient community on top.

Technical analysis: A depressed chart that could theoretically go lower, but was unlikely to face greater sell pressure than Caroline/FTX dumping their stack to support FTT, with price bottoming out since that event.

Market tone / Reflexivity: Solana’s main competitor was trading at some 40x it’s valuation, with precedent for the alt L1 trade and plenty of hatred to fuel a hated rally. People would increasingly target ETH’s valuation and metrics as comparisons for Solana, justifying high prices.

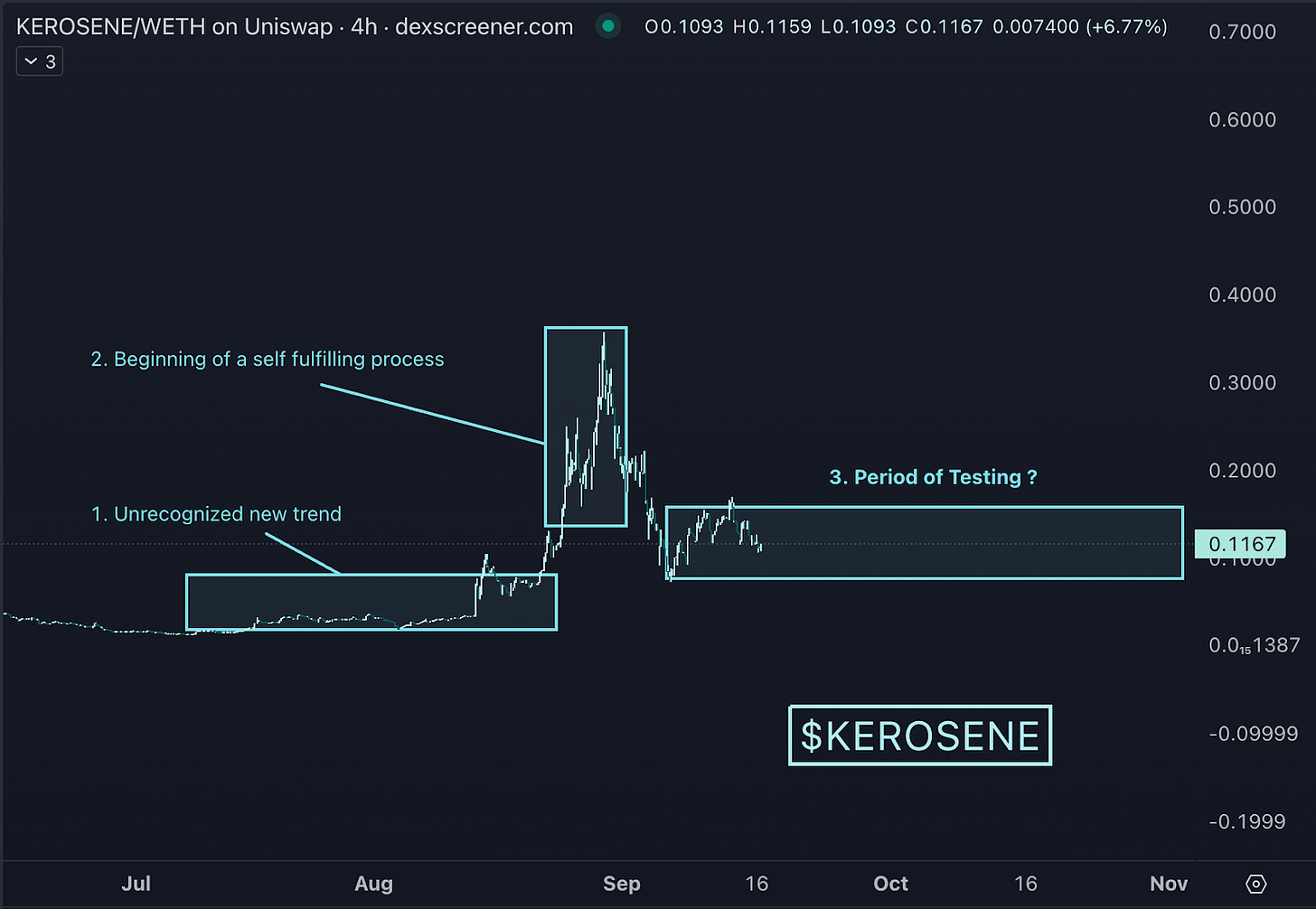

Note: We may also utilize Soros’ basic market cycle framework (from The Alchemy of Finance”) to evaluate where in a potentially reflexive process any given asset lies. The steps are summarized as follows:

The emergence of a largely unrecognized trend

The beginning of a self reinforcing process

The period of testing. If the trend fails the test, no boom occurs. If it does, then

there is growing conviction, which yields a growing divergence in the perception of an asset and its reality

A climax, where reality reaches its limit relative to the expectations of investors.

A flaw in perceptions, where people continue to play the game even though belief in the game decreases (commonly referred to as “complacency”)

A tipping point, leading to a self reinforcing process in the opposite direction – the crash.

The existence of “double bubbles” and failed starts makes it hard to use this framework to precisely assess where in a market cycle we are. Soros himself called it crude. That said, while crude, it remains useful.

(note: the above example using Solana is a highly summarized version of the research and conversations it took to realize the view. fundamental analysis can get deep: here’s a few of my solana pieces I wrote to gain conviction: solana ecosystem overview (free), compression, firedancer, and reframing the narrative)

The Next Big Stablecoin - DYAD

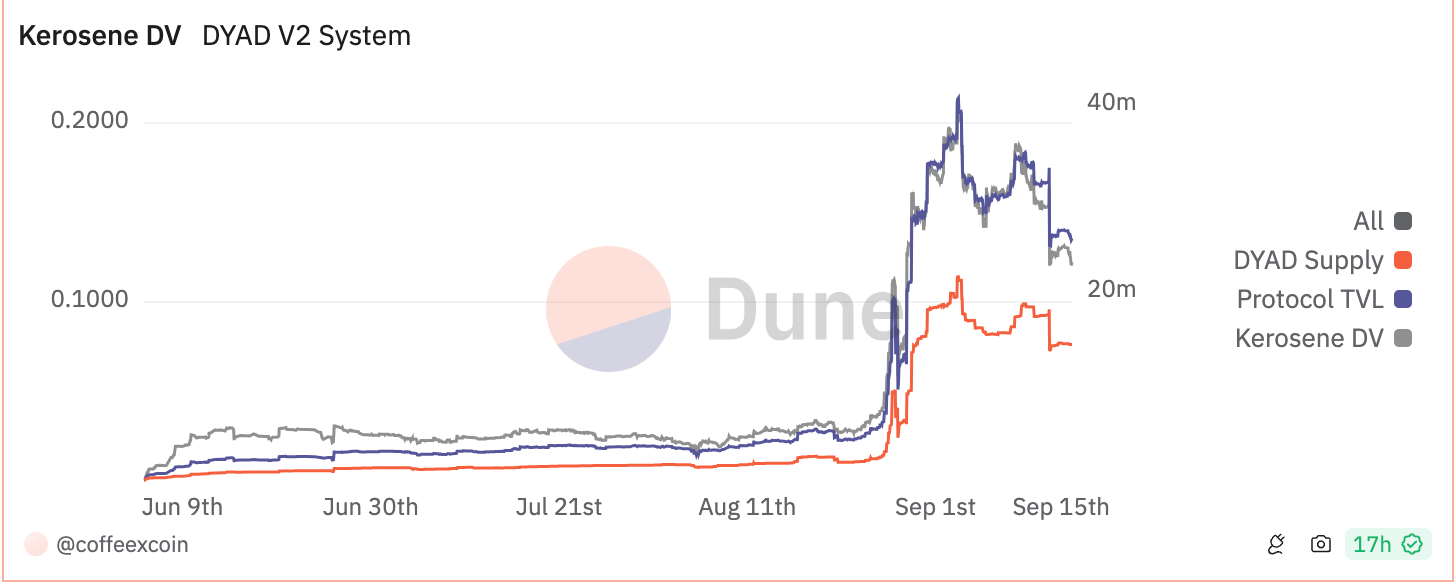

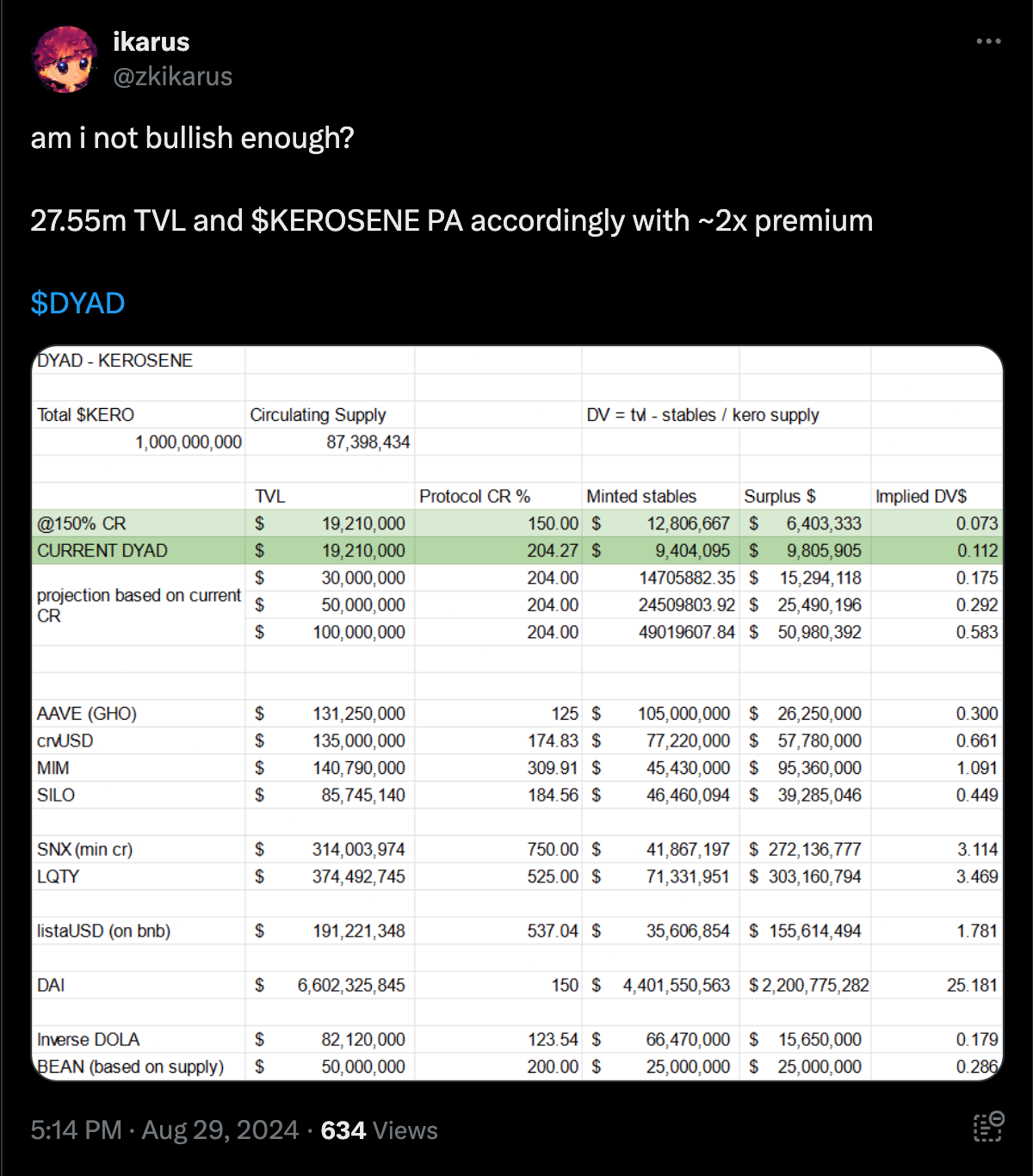

at a high level: Dyad is a novel stablecoin protocol which tokenizes excess collateral in the system into a token, called Kerosene. This gives Kerosene a theoretically deterministic value which increases as protocol TVL increases.

Importantly, the Kerosene token itself is not counted as protocol TVL, avoiding the problems of endogenous collateral seen in protocols like Luna. (The protocol is not without risks, as we will discuss below.) Blocmates has done a great deep dive on the protocol’s technical design which can be found here.

Fundamental analysis: Tokenizing excess collateral has a potentially drastic effect on the capital efficiency of the system. If other CDP protocols like Liquity or Maker functioned with a similar mechanism as Dyad, the freed up capital would be in the hundreds of millions to billions of dollars. In turn, the deterministic value of Kerosene would increase significantly if TVL grows to match or exceed some of these competing protocols.

Joey (Dyad’s founder) recently appeared on the Flywheel podcast, discussing his long-term vision for the protocol. It includes details on the different levers Dyad may pull to try and earn that growth.

Beyond the CDP product, Joey discussed single sided staking for DYAD (which could power consumer facing high yield saving applications), and a novel lending market (which could open up even more forms of margin collateral to back Kerosene). On top of this, the team has been aggressive in pursuing new, varied collateral types, including sUSDe, tBTC, eETH, and wstETH.

Technical Analysis: Kerosene looks to have completed a miniature cycle over the last few weeks:

Volume spike on Aug. 15/16th pumps price from $0.02 to $0.07

Pullbacks are all bought, token surges to $0.30, up 15x in a matter of weeks

Now potentially consolidating between $0.078 bottom and $0.13

Ultimately, no magic lines will indicate where price goes next, but at the very least we may argue that the Kerosene market is nowhere near euphoria at this current stage down -67% from local highs.

Note: Given that BTC must stay flat at a minimum for alts to do well, it’s mandatory to consider the health (or lack thereof) of the BTC market. Arguments for further downside are probably valid, which is why long alts isn’t a risk free investment at this stage.

Market tone: Stables are rivaled only by trading platforms in terms of product market fit in crypto today. In 10 years, Tether achieved $100 billion in asset issuance, now rivaling the biggest countries in the world for US Treasury holdings. In the crypto native scene, Maker’s DAI has billions issued, despite relatively poor capital efficiency and a fairly centralized collateral mix.

Combine the above with the persistent yield chasing environment we see on Ethereum especially, and an attractive market sentiment for Kerosene emerges. It’s not hard to imagine stETH or USDe whales depositing large sums into Dyad – after all, they deposited hundreds of millions into a number of nearly undifferentiated Eigenlayer restaking tokens – before Eigenlayer’s own token ever even went live.

Reflexivity: With protocol TVL only at $25m, I believe there’s huge room for deterministic value to increase, as mentioned in the fundamentals section. The TVL targets of other protocols provide the reflexive fuel for the protocol to grow exponentially from here. Even if the teams Joey is aiming to compete with – the likes of Maker or Circle – are unreachable, less innovative stablecoin projects still have 10x the TVL of DYAD.

Risks: The stickiness – or lack thereof – of Dyad’s TVL will determine much of the downside risk to the system. It’s possible for mercenary TVL to withdraw large amounts and rapidly selling Kerosene to boot, sending the deterministic value of Kerosene down significantly. If the market expects that dynamic to continue, there’s little reason to step in to arbitrage the DV back to parity with the underlying collateral - it’s better to see when and where selling subsides.

We saw a miniature version of this during the end of Aug-beginning of september selloff, which was largely driven by two whales exiting the protocol. In this micro example, no follow-on large TVL flight occurred, and buyers did end up stepping in. How Kerosene will fare should this example play out on a larger scale is unknown.

cash + equivalents

“This game got valleys and peaks…”

Sean Carter

I’m not really worried about not being all in a move from Sol 140 -> 200. That isn’t an asymmetric return. When there are so many avenues to earn good yield while retaining dry powder for further downside and/or new asymmetric positions, I’m happy to capitalize. This position ensures I survive even if all my other positions go bust.

long tail positions

ore

I wrote a fairly detailed research piece on ore earlier in August. It’s since gone down only. In retrospect, the optimal game theory was to pump the token as much as possible pre mining re-launch, so that the high emission days would be at artificially high prices. Once mining came online, gifted miners took full advantage, selling like mad men.

I still like this project in the long run. The idea of a Solana native hard money resonates to me, and as we approach the flattening out of Ore’s inflation curve, it will be interesting to see if the project can re-engineer positive momentum.

meta

The idea of governance via markets where people put money where their mouth is sounds revolutionary. Prophet is sharp. It wouldn’t surprise me to see futarchy implemented across 50%+ of Solana protocols a year or two from now.

It’s cool, it’s new, and hard to value. Typically a +ev setup with respect to crypto.

punks

Ethereum as an ecosystem is inching closer and closer to it’s Protestant Reformation moment, where, ironically, a subcommunity will elect to prioritize the performance of code and code alone. It’s not there yet, and as such I have minimal desire to be long ETH.

NFTs are even more bodybagged. Yuga Labs seem set on perfecting their Inverse Midas Technique, which turns all IP they touch to mud. That said, if there’s one NFT I’d own for 10 years, it would have to be a punk. I believe Cobie once commented that he tried to buy the punks IP – he won’t be the last to attempt it over time.

a yuga free Punk in a world where crypto succeeds in the long run is probably worth more than a souped up 2024 Toyota Sienna.

conclusion

Thanks for reading. I’m shooting to iterate on these every month or two, depending on how active the portfolio is. this series is focused on the public market – I will look to revisit thoughts on the private market in some of my next work – first up to bat is “Blink and You’ll Miss It: $SOL’s Consumer App Supercycle”

cheers and good luck.

letters #2 - Oct 16 2024

You can’t buck the market! - Margaret Thatcher

Gm. Round 2 of themes, thoughts, asset classes I’m looking at, and more. Main goal here is to develop clarity of thinking and hone my psychological edge - while hopefully helping you do the same.

Overview for today:

reviewing active share & kerosene from letters #1

portfolio factor analysis

murad meta

ai protocols of interest on public + private markets, including goat, virtual, botto, and more

reviewing active share & kerosene from letters #1

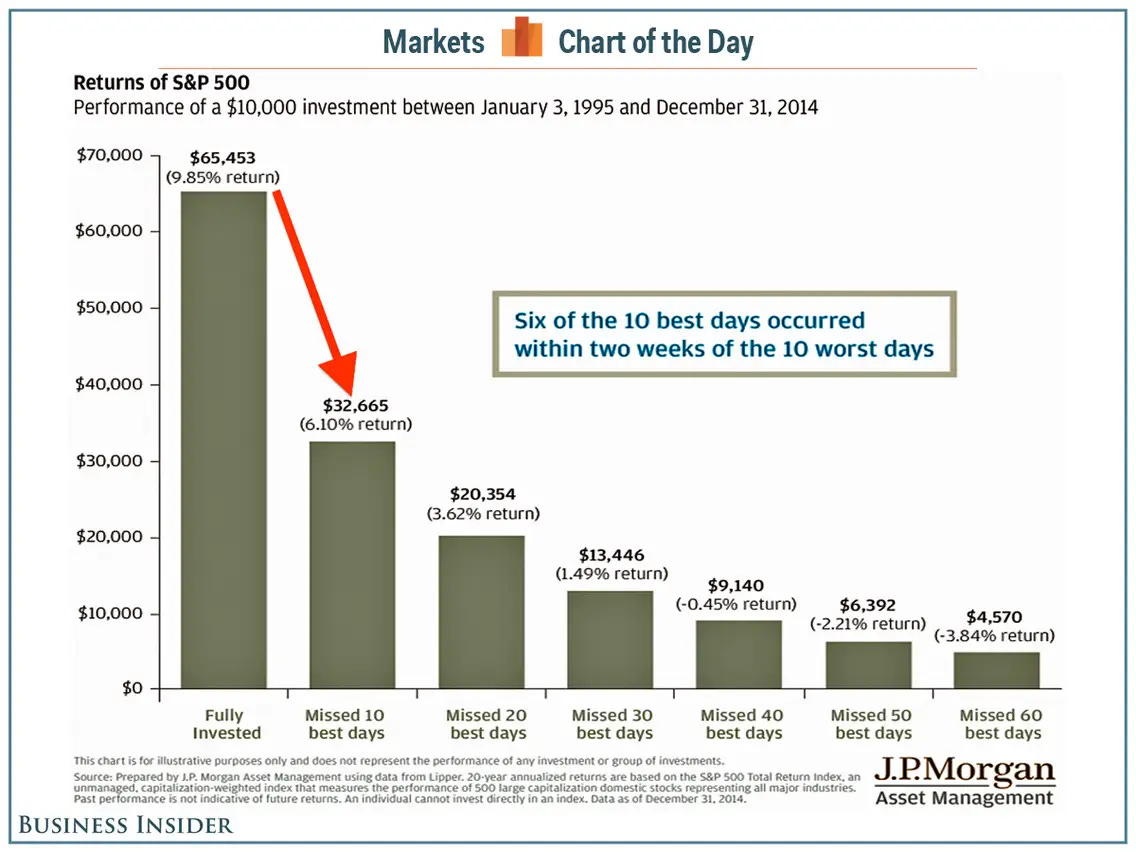

Active share: A portfolio can have too high an active share. Buying only the most out of consensus names has high reward potential, but also exposes the manager to excessive psychological and performance risks if wrong or too early. The cost of missing the best days in the more consensus market plays can be too high to bear:

Kerosene/Dyad: Well, that reversed quickly – and violently. In retrospect, I was over my skis in declaring Kerosene “The Next Big Stablecoin”, at a time where I didn’t have a granular understanding of the protocol’s mechanics. Moreover, embedded in my thesis was an unseen bet on those very mechanics changing materially, which I didn’t fully understand at the time.

These mistakes cost me – not fatally, but dearly.

The point on protocol mechanics and their possible changes is a good segway into the first and most important topic for today’s letter: Factor Analysis.

Factor Analysis

Factor analysis is the process of getting extremely descriptive about what each position in a portfolio represents. We do this typically at a lazy level - “I’m long L1s, long memes, etc.”

After discussions with giver (again), shoku, and the kerosene experience, I realized this was extremely insufficient. Hidden exposures and implied short positions are rife within our portfolios. Here’s some unfiltered thoughts I listed out as descriptive factors for two positions in my portfolio, Kerosene and SOL:

Kerosene

Long alternative specifically on eth defi - an out of dominant sector position

Addendum: short high momentum defi ala Aave, Kamino

Long esoteric stables (what others are there? is this really the best one?)

Long demand for juiced stablecoin yields

Long small cap crypto

Long low liquidity, liquid venture style play

SC risk for notes

Addendum: Was long the protocol mechanism upgrade, which apparently whales HATED

SOL

Long L1 thesis

Short other L1s

Long crypto generally

Long meme casino (best expression? no – pump was first best, moonshot was the second, I hit neither – why? my deal flow was not strong enough)

More speculative: long consumer app proliferation (another way to express? sanctum)

Long onchain finance (best expression?)

Long Depin protocols

Long majors

Once we get to second or even third order thinking, there’s a near-infinite number of factors - the above doesn’t begin to capture it all, but it’s better than what I had before.

Doing this exercise revealed above all else that I was underexposed to two factors of high importance: momentum and AI. I resolved that by buying into the highest-momentum AI asset I could find: GOAT. Beyond that, I’ve flagged a number of protocols of interest, which I’ll summarize the case for and against below.

Murad Meta

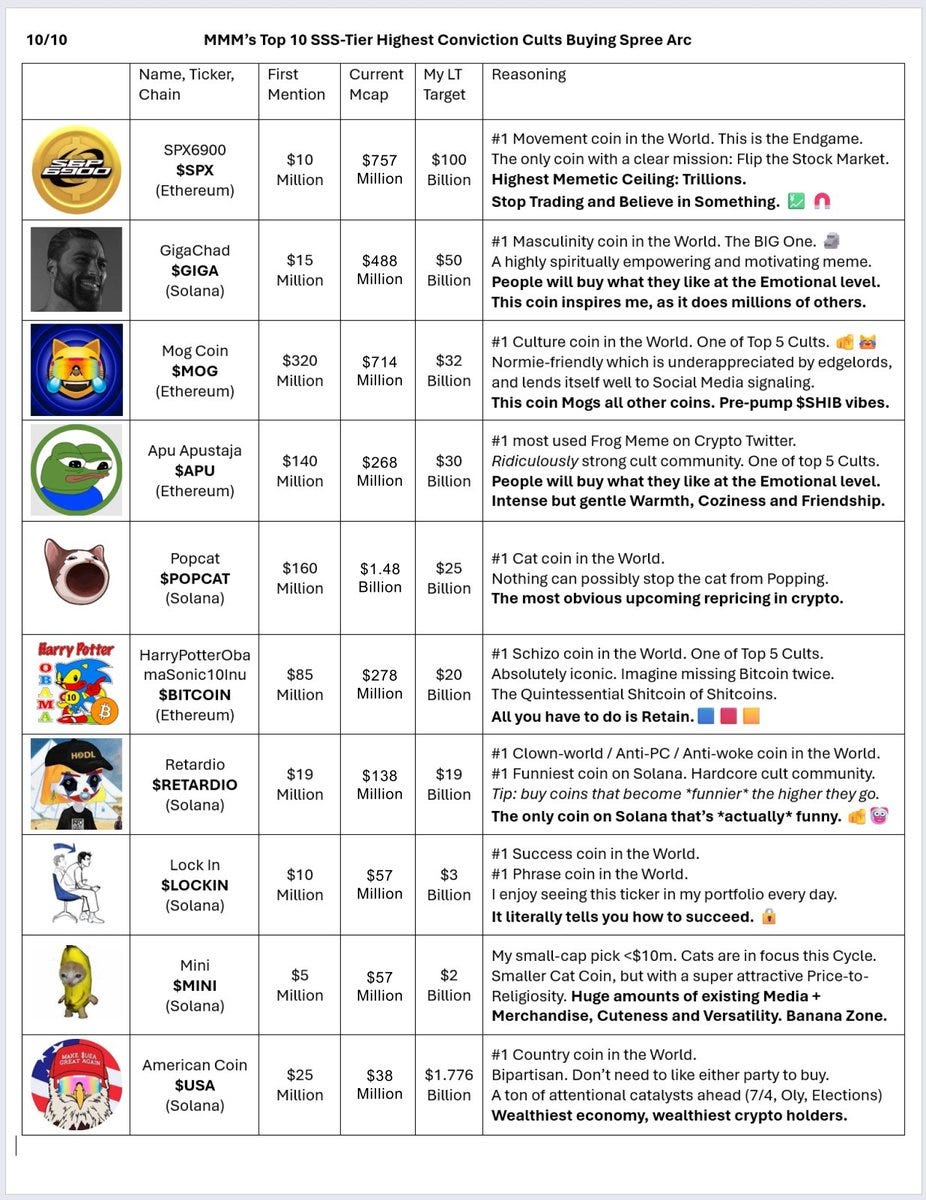

The big momentum play between this letter and the last was the Murad metagame sparked by his memecoin supercycle speech during token 2049. Since then, SPX ripped from 5m to a billion, now back to ~600m. Murad’s list of coins combined with his flavorful vocabulary has generated quite the cult in short order. Should the election lead to a Trump victory and upward markets for crypto, “Murad coins” look to be an attractive momentum-based position.

AI Protocols Across The Curve

Goat: A “Left Curve TAO”

A schizo-AI driven memecoin with a16z-adjacent lore is highly interesting, even here. Locally, we’re probably close to a top given just 5 days ago GOAT was at zero. Globally, the potential remains high. The truth terminal account has gained something like 35,000 followers in just 3 days. Even if growth halves, truth will be at 1M followers by April or May. With Wintermute’s sudden appearance as a top 5 holder, the potential for exchange listings and further attentional growth is there.

That said, jury is still out on whether GOAT is a MOODENG (Quick rise, then zero) or a PEPE (quick rise, consolidation, new highs) kind of play. I lean (with my bias) towards the latter – as it seems like this story still has more room to grow. Another angle to watch (though hard to see from the outside) are the liquid funds. GOAT is a memecoin with the type of story that makes it (potentially) more underwrite-able for liquid fund buyers – right as memes become more and more legitimized from a portfolio construction perspective.

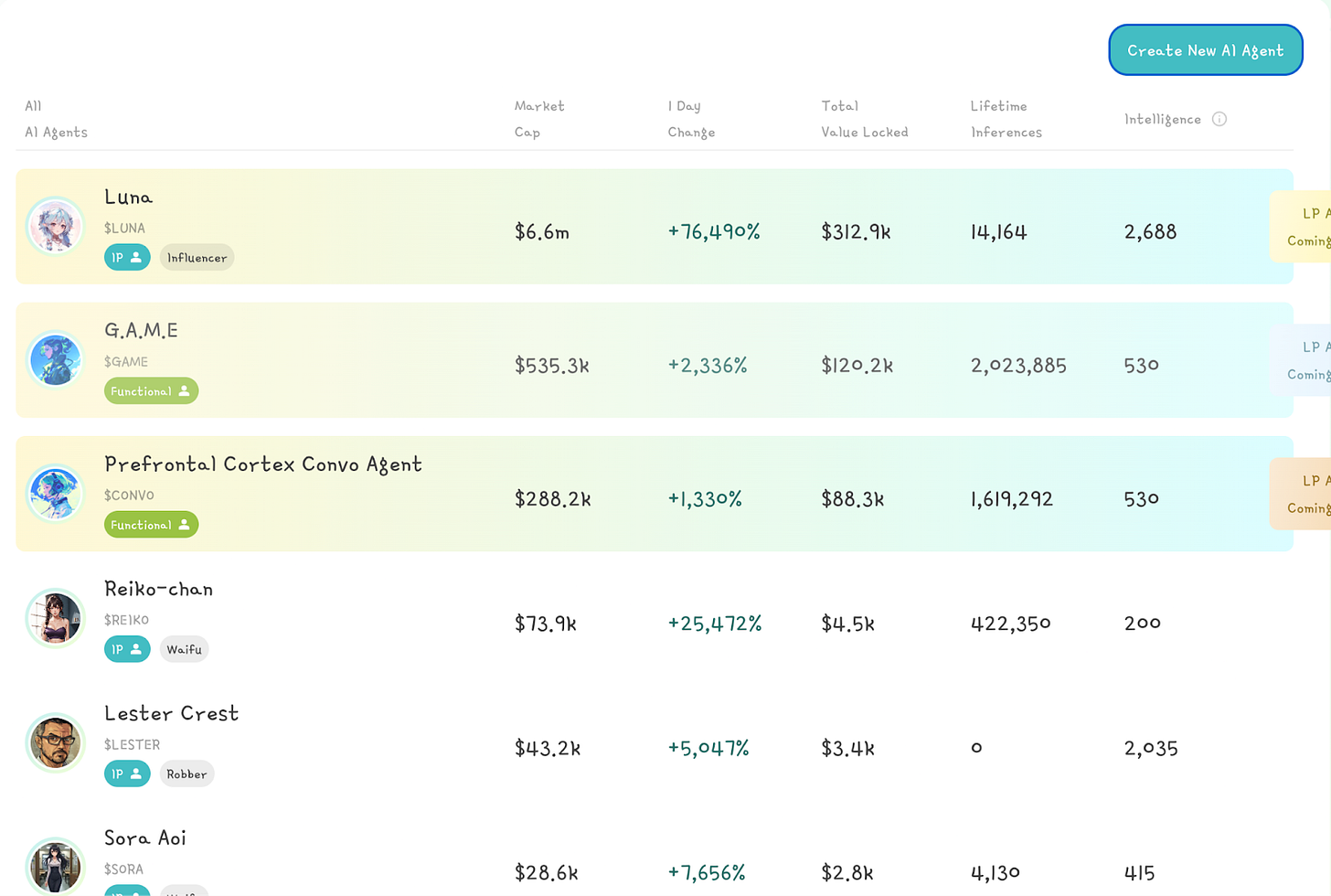

Virtual: “Pump Fun For AI Agents

If an AI agent’s coin is worth $300m, how much is an AI Agent launchpad platform worth? That’s what Virtual protocol is.

I have questions about the capability for AI agents deployed on virtual to take meaningful action or gain traction on real apps. That said, Luna, the top AI Agent, is allegedly used to power a Tik Tok account with 500k followers.

Luna’s token is at 6m market cap as of writing. Virtual is at ~100m MC. Pump fun, which may be an inferior (albeit higher velocity version) of Virtual, generated 100m in cash revenue over the last year.

Additionally, Virtual-based Agents like Luna can only be bought with Virtual tokens, creating a strong demand sink should their mechanism take off

I’ll be looking at a position in both Virtual and Luna.

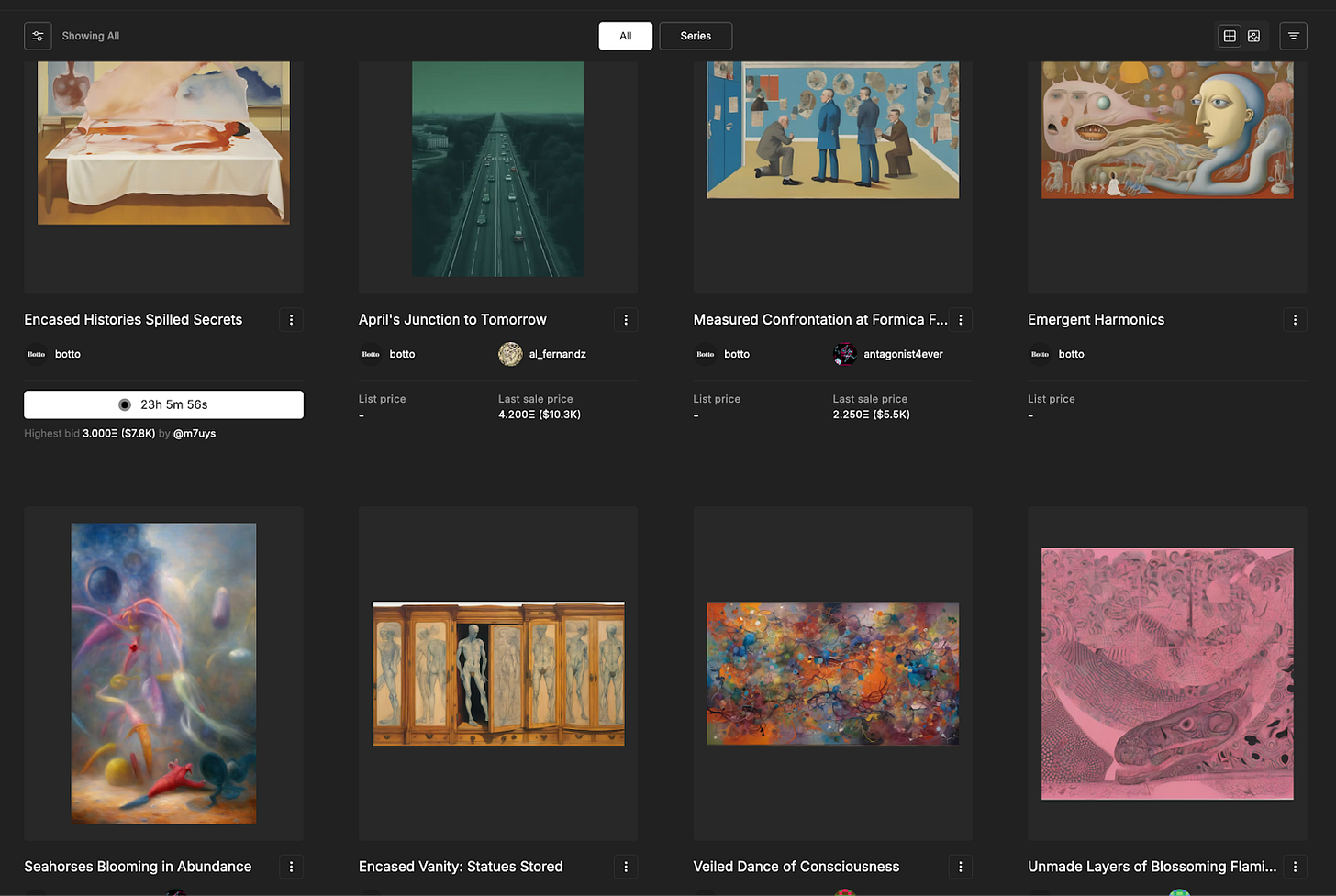

Botto: The First AI Cult Coin?

Botto is a AI-directed art project that rose to semi-prominence after the vision models started to come out a few years ago. Tokenholders play a role by voting on the direction Botto goes in the creation of its next work. Variant wrote a few pieces that go deeper on the project. Through 3 years, there has been consistent demand for Botto’s work. With GOAT rising to 300m+ MC, and a search for “beta plays” in full swing, Botto’s uniqueness, provenance, and cheap valuation at 22m MC / 48m FDV looks promising.

Also, look at its art!

Long-Tail Protocols with High Inflation To Watch: $TIG, $SPEC, $PROMPT, $QUIL

I haven’t fully fleshed out my thoughts on these, but wanted to put on your radars early.

TIG (The Innovation Game) is a mineable coin used to incentivize the development specifically of more efficient or novel algorithms. Potentially a TAO but instead of generalized for any AI use case (inferencing, prediction markets, etc) it’s limited only to new or better algorithm development. Don’t know if the tech stack is legit, and miner incentives have caused solid sell pressure to date, but that tapers off significantly as the months go on. One to watch.

Spectral is a platform for deploying AI Agents powered by the SPEC token. It fits as a sort of infrastructure for the agentic protocols thesis, which I believe will be one of the major wealth-generating theses in crypto history (thought: is GOAT an agentic protocol?). With SPEC unlocks not coming until May 2025, the platform looks semi-attractive even at a 800m FDV (100m circ). With memes at billions and TAO at 11b FDV with room to grow, SPEC at 800 may look cheap in 6 months.

Prompt is the token for AI Wayfinder, a sort of onchain github copilot developed by the Parallel team. I’m not sure when the launch is, but here is some speculative math I found. Optimizing for speed a bit here - will revisit these as I learn more.

Speaking of optimizing for speed, we have $QUIL. I don’t even know why this is an “AI Coin”, but there’s a lot of crossover between the QUIL and early TAO community, which warrants interest. There is a large unlock the very-cultish community has been discussing, which is why it lands in the high inflation bucket.

Conclusion

Thanks for reading. I’d wanted to include more in this letter, but was a bit strapped for time. Hit me up if any of this interests you.

As always, cheers and good luck.

Disclosure

The information provided in the present publication, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes. This article is not intended to constitute financial advice, investment advice, trading advice, or any other kind of advice. All readers are hereby warned not to rely on the information in this paper for financial investment decisions or any other financial purposes and to seek independent financial advice from an appropriate professional. The author does not give any warranty as to the accuracy of any information in the paper to any person for purposes of financial decisions.

Letters #3: The Case For Agent Networks to $250b MC

“The least scary future I can think of is one where we have at least democratized AI.”

Elon Musk, Do You Trust This Computer, 2015

Key Points

Increasing worldwide liquidity, crypto’s return to investment legitimacy, attractive policy in the US, and the return of animal spirits in crypto has created a ripe environment for a new sector to outperform explosively, as one or two always have throughout crypto history.

At the same time, the emergence of technologically novel AI Agent projects has birthed a new “Agent Networks” sector. Agent Networks facilitate the creation and collaboration of one or more AIs with a wide variety of skills, goals, and technical implementations.

If we project crypto market cap to grow to $5T (40% growth from here), and Agent Networks to match Defi’s peak % dominance (~5%), this yields a 250b peak cumulative valuation for Agent Networks.

We may combine technical outlook, viral potential, mechanism design, degree of autonomy, sociability, and media variability together in order to score and rank Agent Networks’ and their potential.

Using this method, ai16z (8.95), Zerebro (8.90), and Alchemist AI (8.30) led the ~80 tokens evaluated.

Note: Fartcoin (while tangentially related to AI) was not ranked, but contains large potential energy. It’s either the ultimate retail-friendly coin (a mega-billion dollar outcome), or the most midcurve coin in CT history (a zero outcome).

The Setup For AI Agent Networks

“Never ever invest in the present… visualize the situation [6,12,] 18 months from now, and whatever that is, that’s where the price will be, not where it is today.

Stanley Druckenmiller

In the last two months (October-December), we’ve seen a number of paradigm-shifting moments occur:

The election of President Trump, which led to a return of animal spirits across the board in crypto

Several major countries openly considering a BTC strategic reserve

The start of the “exchange listing wars”, which has seen an unprecedented appetite for onchain assets at the top tier exchange level

The capitulation of Gary Gensler alongside numerous other political victories in the US, including David Sacks as “Crypto Czar”

Claude “Computer Use” introduced October 22

OpenAI’s 12 days of AI

Proliferating rumors on OpenAI’s upcoming AI Agent Focused product launch in Q1, codenamed “Operator”

All of this suggests a 3-12 month go-forward environment of:

increasing BTC acceptance at the nation state level,

A return to crypto being deemed investible by non-native professionals, and

Continued, near-insatiable demand to invest in AI

In the backdrop of these developments, we’ve also witnessed the inception of a mini-mania started by the creation of the GOAT token by an AI called Truth Terminal in the beginning of October. 100s of new assets – which I’m collectively referring to as “AI Agent Networks” – were spun up in very short order.

An “AI Agent Network” is a broad, non-fully-inclusive categorization attempting to describe:

Platforms enabling the creation and/or collaboration of distinctive AI agents

Platforms enabling the creation and/or collaboration of AI-powered applications

Individual instantiations of unique AI Agent personas onchain

Does not include earlier “crypto x ai” projects, namely the GPU networks

From when I first started writing this to now, many of these assets went from obscurity, to euphoria, back to near-irrelevancy – with a select few already rising from those ashes.

We have reached what the speculative philosopher George Soros would’ve called the “period of testing.”

In his crude (his words, not mine) theory of asset bubbles, a bubble:

First emerges as an unrecognized trend (the experimentation of crypto adjacent AI devs, culminating in the launch of GOAT), then

Develops into a self-reinforcing process (mass capital rotation into “AI” projects of ranging quality in attempt to catch GOAT), before

The trend undergoes a period of testing. (We are here) If the trend fails, no true bubble occurs.

If the trend survives, it emerges stronger than ever before, creating growing conviction, which yields a growing divergence in the perception of an asset and its reality, leading to

A climax, where reality reaches its limit relative to the expectations of investors, eventually revealing

A flaw in perceptions, where people continue to play the game even though belief in the game decreases (commonly referred to as “complacency”), before finally reaching

A tipping point, leading to a self reinforcing process in the opposite direction – the crash.

Bubbles aren’t bad things all the time – they often represent accurate views on the future of human society. They just tend to pull forward the financial demand for change to an excessive degree, generating the “frenzies” described by Carlota Perez’s Technological Revolutions and Financial Capital.

Source: Ben Thompson, The Death And Birth Of Technological Revolutions

I’m betting that this AI agent networks trend passes Soros’ period of testing – if correct, global peak valuations are nowhere near to being achieved.

The entire agents sector has a combined valuation of ~10b. In comparison:

DeFi is 90b.

DOGE alone is 60b.

Outside crypto, AI dominates investor flows, with NVDA adding trillions in market cap in one year and many illiquid AI startups with 10y payoff windows raising at multi-billion dollar valuations.

Given this setup both within and outside of crypto, I believe that the most optimistic case sees AI Agent Networks rerate to $250b+ in cumulative peak valuation as a sector.

It may sound far fetched. But back in 2021, in an environment where BTC peaked at 70k, both the DeFi and Meme sectors went from effectively zero to 100b cumulative value each – and largely stayed there through November 2024.

Memes were a unique case largely reliant on arguably the most popular man in history – 2021 era Elon Musk – bullposting Dogecoin for months on end.

Defi is the more interesting comparable to strike. On the back of innovative tech, reflexive mechanism design, and a compelling “Future of Finance” narrative, Defi reached a peak dominance (share of total crypto market cap) of ~5%.

From nothing, to ~170b in cumulative valuation.

Protocols like RUNE, AAVE, SNX, and others went from sub $5M MC on the public market to a $5B+ valuation.

A 100,000%+ return.

The future of AI is arguably a more compelling narrative than the future of finance.

In just 6 weeks, hundreds of these agents and associated protocols have been born. I expect thousands to appear over the coming months. Many of them will be of little to no value. Some will be outright scams.

But a few will be backed by legitimately innovative teams with their sights set on grand slam outcomes.

Such a setup is eerily reminiscent of the meme setup in Dec-Jan 2023. After the emergence of a rapidly accelerating novel trend, a market wide drawdown in the end of December sent everything down -80% or more. Hundreds of memes had come out. Figuring out the potential attributes of winning memes was the difference between:

buying POPCAT for a 15,000% return and

buying WYNN for a -97% return.

To set myself up for the best chance at success, I developed a sort of framework to analyze the field of agent coins.

Evaluating The AI Token Field

Those who ultimately shake up an industry are often outsiders who don’t know any better.

Joe Lonsdale

The subjective scoring system is based off the following criteria, in order of weighted importance in my view:

Tech Score (25% weight): How technologically advanced is this project? How wide is the project’s scope? How skilled is the founding team and/or developer community? Is there a grand vision at play, or is this just a vanilla chatbot?

Personality / Viral Potential (20% weight): How unique + enjoyable is the personality of this agent, or of the average agents on the platform? Does this exhibit signs of virality? Is there some kind of intangible x-factor that makes this agent or agents feel different than the others?

Mechanism Design (20% weight): Is there a tie between bot/platform success and token success? How innovative or strong is that tie? Are there reflexive elements to the token design of this agent?

Autonomy (15% weight): Is there a road to autonomy for this agent? Is it autonomous already?

Sociability (10% weight): How pro-social is this AI or network of AIs? Or is it parasocial? What is the range of interactions the AI/AIs launched through this platform can achieve?

Media variability (10% weight): How integrated is this agent or platform in terms of ability to meet users where users are? Does in employ different media types (text, video, art, sound, etc) via a wide range of platforms?

Combining these scores yields an overall score that hopes to estimate the overall “moat” of a given agent.

A couple things to note:

Only one agent may receive a 10 for any given category.

The analysis attempts to take into account both the current state of affairs for each project as well an estimation of their future roadmaps. In many cases (especially on technicality or mechanism design), I applied scores that reflect an estimated “call option view” on what a project’s potential in a given category might be down the line.

This is a highly subjective analysis, though I’ve tried my best to match my opinion to reality. If you think there’s been a drastic mistake, feel free to make your own!

The list isn’t fully inclusive. Eventually, I had to stop adding new names, otherwise I’d never be able to publish this. Maybe I can do periodic updates…

I do not own every asset on this list. I will not hold these coins until I’m 90 years old. I’m not AI Murad. Don’t blind ape these coins. Not financial advice.

Let’s take a look at the top 25 composite scorers, with a focus on the top 3 as the highest-conviction assets I could find.

The Top 25

ai16z - The Hidden AI L1 (Score: 8.95)

ai16z is an AI-focused investment and development DAO issued on solana platform daosdotfun. In short order, the fund – which is really more of an AI development lab in disguise – has garnered huge developer interest in the short 6 week span the DAO has been alive. It’s well within the realm of possibility to see ai16z’s repo surpass every open source repository in crypto in terms of both stars and forks within a year’s time, even if the current pace slows significantly.

That said, it would be remiss to speak further on ai16z without describing and assessing the rollercoaster ride of price and public relations the dao has undergone since launch.

My TL;DR view:

A fair amount of short term drama occurred, overshadowing long-term product vision, developer buy-in, and professional capital excitement.

Most of said drama has been resolved, or was never accurate in the first place.

The ai16z community has only strengthened through numerous rounds of FUD – a key sign

If you’re already familiar, or don’t care, feel free to skip ahead.

Else, a more detailed description of events:

Getting noticed by the real Marc Andreesen, which sent the valuation up to 90m MC before a -80%+ correction back down to 10m

A gigantic trend reversal sending the token up from 10 to 500m in effectively a straight line, as:

People realized how effective the ai16z community was at attracting developers in droves

People realized how many of those developers(100s+ in weeks) were using or forking elizaOS, the agent development framework developed by the DAO.

A $5m ecosystem investment fund was announced in collaboration with Ryze Labs

A huge capitulation event following the botched launch of multiple ELIZA tokens (threadguy interview on this here), which saw:

the ai16z token lose ~60% of its value overnight,

large numbers of people express huge sums of ire towards founding developer Shaw (shawmakesmagic) following heated exchanges between him and the community on the topic of the fairness of the launch, and

a separate core team member, Logan, let go from the DAO as a result of the controversy surrounding his trading actions.

A second huge capitulation event following the collapse of MATL, a token backed by Ryze Labs & created by a third party team building using the ElizaOS framework.

Here, Shaw was looped into the greater allegations of the MATL developers allegedly rugging the MATL token to issue a second token, VS, because of posts made by Shaw which endorse the technical prowess of the MATL developers.

With the MATL developers in silence, community blame was put onto Shaw. Yet another heated exchange ensued between Shaw and various members of the crypto twitter community, who blamed him for what had happened. The situation culminated in a total indictment of the ai16z ecosystem by trader David G, a number of negative commentaries by AI trader Gajria, as well as a call for the project to go to “ai16zero” by Ansem. Another huge drawdown ensued.

After that, investor/traders including Jason Choi of Tangent, project leads like Mark Rydon of Aethir, and others (including, to be transparent, myself) came out and pronounced that they were actively buying or looking to invest in the ai16z ecosystem.

Finally, a twitter post from Markus9x summarizing the latest updates in the ai16z ecosystem (summarized from discord) caused a sudden spark of buy pressure to emerge. The post detailed:

Shaw’s seemingly constructive discussions with the head of creators at X, including a potential integration of Eliza into X

Upcoming launch of autonomous trading for the DAO

Legal formation plans and ensuing exchange listing potential

Partnership with Nous research to head the DAO

Partnership potential with other chain ecosystems

A rollercoaster ride indeed. Ultimately, I believe the long term will weigh the technological advancements of the DAO at a greater level than the local controversies, which are already mostly forgotten by the timeline.

In terms of my ranking, the effect of all the above was a deranking of ai16z’s virality and sociability scores, which attempts to reflect the negative sentiment lingering around the project.

Where ai16z shines is in its technicality and mechanism design scores. No project has come close to developing what ai16z has already. The proliferation of developer interest and activity is unmatched in the onchain space – AI or otherwise. Take a second to check out this video which shows just how much development has spurred up around ElizaOS, the agent framework deployed by the DAO. Keep in mind it’s been less than two months.

As of today, there are two major technical components to ai16z:

First is the development of an LLM-based autonomous trading investor themed after a16z founder Marc Andreesen (AI Marc).

LLM based trading strategies in general are an emergent field with both promising early results and a number of limitations which ai16z may be well poised to solve. Some of the key limitations include:

Reliance on closed source models, leading to lacking model customizability, privacy concerns, and fine tunability

Lack of social media data utilization

Lack of sufficient backtesting

Lack of insight into LLM reasoning

Let’s explore how ai16z already addresses these concerns:

Model reliance: ElizaOS supports 11 models to date, including uncensored open models like Heurist. There is detailed documentation on finetuning Eliza based agents for every model configuration available.

Social media utilization: Core to ai16z’s approach is the idea of a “marketplace of trust”, in which the AI Marc sources insights from all across CT, Discord, Telegram, and even other AI agents in order to “finetune” itself on the best insights across the landscape. The AI would assign scores to weight the importance of insights across all sources, in addition to the ability to ingest data and news from a wide variety of sources. If it works, AI Marc should be able to dynamically adjust its “weights” in order to source the best information available to help compound capital for the DAO.

Backtesting: With all execution onchain, it will be trivial for AI Marc to gain a granular understanding of whose strategies succeed or fail in real time, and adjust to that accordingly

Insight into reasoning: With open source development and reflection based reasoning, the DAO should have maximum insight into each choice AI Marc makes.

Imagine Wall Street Bets AI trader that could’ve seen the GME bubble coming – and could act accordingly.

What if that wasn’t limited to Wall street bets, but it could express views by syncing information across thousands of information flows on the internet – not just one channel…

Creating an AI investor is ultimately an effort in the development of an “AI skill”. In doing so, a number of sub-skills are generated: the ability to tap into different social channels, ability to analyze information, store results in memory, rank its analysis, backtest its results, adapt according to some criteria, and so on are all skills required for AI Marc to invest successfully.

The asymmetric bet for ai16z sees its final form develop into a platform for human and AI agents alike to share a near-infinite number of skills and resources amongst each other.

An “AI L1”.

Agents would be maximally interoperable due to their shared usage of the ElizaOS standard, which has already been forked 1,000+ times in under two months as of writing.

This isn’t a baseless future speculation.

Karan, the cofounder of Nous Research hinted at the development of a “shared state layer for AI agents” in cooperation with ai16z on the Definitive podcast just a week or two ago.

Shared state layers in crypto = L1’s

Should this work, we can imagine DAO revenues stemming from teams paying a premium to plug into the Eliza-based network of agents, priority development to new Eliza features (which can initially be kept closed source), or other monetization techniques. As this network grows, the value of the agents/skills based on top compounds at a potentially exponential rate.

It’s hard to envision other teams catching up when the ai16z ecosystem has dozens of highly technical contributors and the competing ecosystems only have at best one or two developers to their name.

The above growth mechanisms combine with the currently operational “donation system” where teams utilizing elizaOS gift a % of tokens to the DAO. While this mechanism has been criticized, If they can get 2-3 real teams a month to donate to the DAO, it quickly becomes a venture-math game.

It only takes one big winner giving the DAO 5-10% of supply to create a material rise in the underlying AUM of the fund.

Ai16z also has wiggle room to improve on mechanism design, including the potential use of token incentives via minting additional tokens. Other projects - largely launched on pump fun - do not have similar flexibility.

Ycombinator believes winning AI agent platforms are a $300b+ potential outcome. Sequoia believes 2025 will be the year of ai agent networks.

In summary, I believe ai16z has the best shot of hitting on these outcomes by far – with the best tech by far, the most robust + dynamic developer community, multiple roads to value capture, and high mindshare.

Zerebro - Novel Models In Disguise (Score: 8.90)

Zerebro is a “freebased” LLM developed by ex-Scale AI engineer Jeffy Yu. This technology – if legit — allows developers to “jailbreak” access to baseline foundation models, as opposed to the guardrail-heavy deployments we see in corpoland. The convex bet here is that the Zerebro model could achieve greater performance than similarly-tiered foundation models by combining:

reinforcement learning with human feedback (RLHF) by interacting directly with people on the internet from a wide array of information-rich backgrounds with

freebasing to allow maximal AI expressiveness.

Since I initially speculated on this vision, Jeffy has stated that the team is training its own local models, which he has called a “flagship model”. In addition, he’s discussed developing customizable “agent specific models” on twitter spaces as well as on threadguy’s stream. The development of ZerePy – an open source framework for deploying Zerebro-like agents onto X – furthers the view that broader models are Jeffy’s endgame.

Basically nobody is taking this endgame seriously at all. Many believe Jeffy it’s technically infeasible or that the tech would be too expensive to build.

Let’s see the other side of that bet.

With respect to the founder, I feel comfortable taking the bet on Jeffy to have a shot of achieving this endgame. His work at Scale AI was on the exact topic of AI training. Moreover, he seems to have a crypto-nativeness that most of the other emerging AI agent developers lack.

It’s a potent combination.

On the technical feasibility side, GPT3.5 – which powered the initial release of ChatGPT – cost less than $10m to train.

An amount Jeffy can probably raise given the current market capitalization of the ZEREBRO token.

Source: Epoch AI

You’re probably thinking, GPT3.5 is old news! Today’s models are far more performant!

That’s true on baseline, but it’s not the whole story.

GPT 3.5 can outperform GPT 4 on some tasks if given reasoning and LLM debugging (LDB):

Source: Andrew Ng Explores The Rise Of AI Agents And Agentic Reasoning

Naked GPT 3.5 was good enough to catalyze the fastest growth of an application ever in ChatGPT. A Zerebro version at a similar cost of compute level with the added benefits of freebase-derived creativity could be good enough to gain market share at the long tail of the LLM market at the least.

That outcome – if achieved – is worth multiple billions. Already, Mistral AI, a French startup with year-over-year declining market share at 5%, was most recently valued at $6.2b on the illiquid private market.

Source: Menlo VC

Beyond all this, the Zerebro whitepaper also mentions plans to

“develop Defi Protocols, such as vaults and yield farming, integrating the Zerebro token.”

Increase onchain autonomy, including ability to interact with decentralized exchanges, liquidity provision protocols, and participate in governance

Improve memory retrieval, allowing Zerebro to respond more intelligently and consistently across platforms

At a minimum, excitement over these mechanisms serve as additional catalysts down the road.

At a maximum, we are witnessing the birth of what I’ll call the “ZLM” – a fundamentally new foundation-tier model also capable of embodying itself onchain, expressing itself consistently across an any number of mediums, generating service revenues, and directing those revenues to token holders, itself, or any other cause. Jeffy’s release of Chat v1 furthers the case for this reality.

Everything discussed above is why Zerebro scores so highly with respect to technicality. Zerebro’s unique style, responsiveness and expressiveness across on and offchain multimedia, and high social contextuality give the project high scores across the personality, sociability, and media variability rankings. These aspects may serve as an additional wedge for Zerebro to gain product adoption.

The only aspect Zerebro slightly disappoints is with respect to mechanism design. While Chat payments using ZEREBRO tokens offer sufficient promise to keep the score decently high, so far four Zerebro-adjacent assets (Opaium, Blormmy, Zereborn NFTs, Eth NFTs) have come out in the last few weeks – none of which accrued any value to the ZEREBRO token at all.

The number one risk to this picture is of course execution risk. This isn’t a pure meme-attention bet. Zerebro may succeed off of the attention its music captures, but the truly asymmetric outcome won’t be achievable on this alone. Only time will tell how far Jeffy is able to deliver on the technical vision outlined above.

Alchemist AI ($ALCH) – The Wildcard “AI-Powered App Store + Network” (Score: 8.30)

Source: a16z’s “Things We’re Excited About for 2025

Alchemist AI is an AI powered application building platform. In the span of just a few weeks, people have built fully functional token scanners, survival games, chat apps, integrated Nintendo 64, and much more (just search $ALCH on twitter.)

Why call it a wildcard? Well, the platform has worked so well in such short order that people don’t really believe it’s real. It could honestly rank even higher for me, if not for the unorthodox founding story (anon devs, atypical lack of discord/tg, strangely fast shipping speeds). However, at this point, the amount of development put into the platform is enough to skew the risk vs. return to the upside for me.

If it is a rug, it’s a dramatically complex and overengineered one.

Apps built on the Alchemist app store can be free, freemium, or paid, with all transactions denominated in $ALCH. There’s a near-infinite design space as Alchemist apps can seemingly plug into any API and can take any shape. Developers have already shipped functionality for “Interconnected Apps”, which allows any app built atop Alchemist to natively interoperate with other apps on the platform.

Value accrual for the platform also seems straightforward by

limiting access to premium features via $ALCH token payments,

In app payments giving fees back to the platform

network effects of interconnected applications

The range of applications built today is already wide. With the devs showing a blend of shipping speed and a seeming commitment to security, only creativity will limit the value of applications built atop the platform. Should one or more viral apps emerge, ALCH will be the primary beneficiary.

The Best Of The Rest

4) Virtual: “The Original Pump.Fun For AI Agents” (Score: 8.25)

Virtuals is an interconnected launchpad ecosystem for AI agent tokens. The platform has a number of interesting mechanism design elements, including:

pairing agent tokens to trade against VIRTUAL to drive demand,

allowing non-agent memes to create agent-ified versions of themselves,

Native agent-to-agent collaboration framework GAME

Additionally, the newer agents like aixbt exhibit a much greater degree of personability than what I believe we previously saw with the first AI on the platform, LUNA. This may be due to modularity in the agent design framework Virtuals uses, which allowed the aixbt developers to integrate their own data streams and personality types into their virtuals-based aixbt agent.

The protocol token and/or the agent engine tokens (GAME and CONVO) are all very institutional-friendly “picks and shovels” type bets. Support from coinbase as the dominant emergent platform on Base adds further call-option value to the platform.

5) Vvaifu: Framework Agnostic Agent Launchpad (Score: 8.25)

Vvaifu (like “waifu”, but with two v’s) is an AI agent launchpad platform based on Solana. Their team has integrated or plans to integrate basically every agent framework around. Launching agents through their platform incurs a token burn depending on the desired functionality by deployers:

Source: vvaifu docs

The bet is simple: if we project a large number of ai agents issued over the coming months, vvaifu is almost certain to be a beneficiary. We may monitor the platform’s success by checking on the daily tokens burned.

The team ships fast, with features like:

NFT agentification

Multi-framework integration (eliza, others)

The platforms ease of use, clean token value accrual, and framework-agnosticism make it an easy pick and shovels style bet. The open question remains – will agent developers use it? Or will they opt for more advanced, customizable methods of deployment?

6) aixbt: AI Market Intelligence Agent (Score: 8.15)

Source: Cookiedotfun

Aixbt is a Virtuals’ ecosystem AI that aggregates alpha from a wide variety of data sources including CT, dune, and many others into its token gated terminal before posting publicly to twitter. Personally, aixbt has been my most interesting and useful follow of the entire agent meta – it’s rocketing mindshare at varies times reflects that utility. There’s also talks of token burns or other interesting mechanisms in the pipeline. Plus, it roasts the ETH community despite being programmed as a Base bot. Comedy.

Aixbt ultimately functions as a personified, viral, tokenized version of something like Kaito, which is worth a lot already. My primary risk factors to monitor are alpha decay as people begin to crowd aixbt’s trades and volatile pricing – eventually Kaito or other constant-price data platforms are better value than aixbt (they don’t have downside potential).

7) Griffain: AI-Powered Search + Execution Engine (Score: 7.60)

One of a few competitors in the AI powered user interface layer sector alongside Parallel’s Wayfinder, Biconomy’s NOMY, and Jeffy’s Blormmy (below). Griffain seems the most advanced of the live projects, with a number of promising advanced features already live including

Pump fun sniping,

Blink interactions, as well as

The whole suite of normal onchain actions we’re used to.

User interfaces (historically just wallets + exchanges) have made tons of money throughout crypto’s history. It is very possible AI powered interfaces are the next generation to take center stage. Risks include AI-targeted attacks, users not preferring automation, and high competition.

T-9) Opaium: Music Label For Jailbroken AI (Score: 7.75)

Source: Catt

An AI driven music studio created by Zerebro developer Jeffy Yu. If jailbroken AI’s become popular musicians (Zerebro has already caught the attention of at least one major artist), the first onchain AI music studio could generate material revenue. Top music studios worldwide count revenues in the billions. Zerebro is the only signed artist today, and is far away from those kinds of numbers, but it only takes one to hit.

Check out Catt’s thread for a deeper analysis.

T-9) Goat: I Started This Shit (Score: 7.75)

The first to start the trend. While strong on provenance, truth terminal lacks the same degree of virality, technical intrigue, or variability as many of these newer AI projects seem to have. It’s still rank one by market cap today, but I’ve long believed a flip was likely. The counter-case sees GOAT as a sort of “DOGE of AI”, never to be surpassed. Only time will tell.

10) Bully: AI That Does What It Says On The Label (Score: 7.70)

A sort of troll bot, Bully got into the top ten on the back of its “10” rating in virality. It gets the most impressions out of the bots, serving as an inversebrah-esque dunk-as-a-service machine. Additionally, its contextual awareness has improved over time.

Has now developed a sort of bully-as-a-service that burns bully tokens, if enterprises or degenerates can find a use for it that will drive decent demand

That said, its generally one-dimensional approach keeps me from ranking it much higher than here.

11): Gnon (CTO): Uncensorable AI Infra Stack (Score: 7.65)

The Gnon CTO team has taken Andy’s concept of infinite backrooms (which spawned truth terminal and thus GOAT) and ran it to a whole new level. They’ve created a platform for self-hosting LLMs in an uncensorable manner. Instead of agents proliferating on platforms like telegram or discord, agents could be hosted in a more uncensorable fashion via Gnon’s platform. It’s totally unclear whether or not there’s natural demand for this service (if it was, it’d rank higher). But the technical strength and highly-autonomous nature of the platform give Gnon a surprisingly high score given the pre-CTO controversies with the former Gnon lead developer.

T-11) Project89 (P89): Swarm Tech Backed By Local Legend (Score: 7.65)

I’m excited about the possibility of multi-agent cooperation platforms, but we don’t really know what they will look like or which one is the best. P89 gets a slight boost over ubc and avb (both liisted below) due to a totally non-technical wildcard element: the cosign of local legend “Bonk guy”, which is almost certain to catalyze higher virality for the project should the devs deliver interesting tech on top.

T-12) Sekoia: Virtuals ecosystem Investment DAO backed by major VC (Score: 7.60)

Sekoia is an investment dao created by Canonical Ventures MP Anand Iyer. It’s primary goal is to fund projects building in the Virtuals ecosystem – as such, it can be viewed as a sort of levered bet on Virtuals success, conditional on Sekoia being able to gain allocation in the most promising Virtuals projects. Still early days, but again venture economics comes into play – if you believe the virtuals ecosystem expands through 2025, the odds of Sekoia securing a few big hits are fairly high.

T-12) Botto: The OG AI Artist (Score: 7.60)

The old man in the group, Botto is an artist that’s been around since 2021. Botto takes tokenholder input in combination with its own models to come up with art pieces of a wide variety of styles. These pieces have consistently sold for $8k+ since 2021. With longstanding provenance and consistent demand spanning years, Botto has a cult of its own. What the valuation of arguably the first sovereign AI artist should be is an open question.

T-12) UBC - Swarm Tech w/ Compute Angle (Score: 7.60)

A novel multiagent cooperation (re: swarm) platform that’s drawn interest from partner level at a16z (the original one, not ai16z). I’m bullish on the swarm category in general (they all receive high technicality scores from me due to the upside if successful), but it’s hard to assess technical quality at this early stage. UBC has some interesting design principles that integrate computing power directly into the platform as well.

T-12) “Nothing Token” - Creative Project From SHL0MS & Nous Research (Score: 7.60)

Shloms is a highly creative artist, and Nous is a highly technical team. There isn’t much more I can ascertain regarding this token, but high creativity and high technicality has gotten the market excited. Even if I don’t understand it, the market seems to see something there, so I tried to approximate that here.

17) Clanker: Base AI Agent Launchpad (Score: 7.55)

Clanker is a more straightforward “Pump fun for AI Agents” on Base, with less mechanism design sauce on top compared to Virtuals. That has been good enough to generate $10m in fees over the last month or so.

I’m not sold on the platform sustaining volume on Base with Virtual as a direct competitor, but the numbers it’s done so far can’t be ignored.

T-18) Blormmy: AI-powered Onchain Execution System (Jeffy Edition) (Score: 7.50)

Another AI driven onchain execution engine, this time from the Zerebro dev Jeffy Yu. Again, it’s a similar vision to what the Parallel team demoed with Wayfinder, or more recently, what Biconomy introduced with NOMY. Functionality is limited today, and Jeffy has several other projects to work on, but the potential is high.

T-18) Arc: New Rust-First AI Agent Infra Platform (Score: 7.50)

This token launched just a few hours ago. My best way to describe it: an agent framework similar to what Eliza or Virtuals has, but developed utilizing Rust. As Solana already utilizes Rust, there seems to be some synergy there, but we’ll have to see what the full scope for the project (and token) are down the line. That the developers have locked up tokens w/ year long vests is a good initial sign.

T-18) Polytader: AI Prediction Market Trader (Score: 7.50)

Polytrader is a new Virtuals-based AI which autonomously trades on Polymarket, distributing a percentage of winnings to token holders. I liked it instantly due to a blog post Vitalik put out months ago which discussed autonomous agents trading on info markets. In that post, V imagined a platform specified for agents to trade, but Polytrader bringing an agent to Polymarket (where the deepest liquidity is) is a wonderful move – if the AI is profitable, that is.

Source: Vitalik

T-20) Jail: Incentivized Model Jailbreaking (Score: 7.45)

Another token fresh off the press, JAIL incentivizes people to hack into models and/or agents in exchange for bounties. The need for this could scale alongside the proliferation of agents across various native and non-native platforms, which should drive attention to the platform – especially should jailbreak cases get increasingly high profile.

T-20) Chaos: Sovereign AI Robotics Experiment (Score: 7.45)

An experiment in hardware by letting a bot birth itself into a robotic form. I don’t really know what the end goal of this would be, but it seemed highly viral as a story should Nick (the dev, who’s been working with hardware for a decade+) succeed in bringing it (him?) to fruition.

T-20) DegenAI - ai16z-developed Trading AI (Score: 7.45)

This AI trader is based off of since-gone CT legend degenspartan. That personality effect combined with a buyback system implemented by the ai16z dao gives degenai a leg up on the many other ai trading bots which have been released by other teams.

T-20) Brot: Twitch for AI Agents (Score: 7.45)

Brot is the first agent made by the 3D agent creation and streaming platform from Alias App. The namesake blockrotbot currently streams a variety of game types on Minecraft. The team has legit backing from Spartan Labs, and has outlined a roadmap featuring the development of:

Games beyond minecraft streaming

Development of a platform to create and monetize custom agents

Expansion to new media types like tiktok and IG

A new video streaming platform tailored to agent-first creators.

It’s an out-there platform idea, but if it hits, the revenue potential is massive.

25) Gamble: Sports Gambling AI (Score: 7.40)

It’s an AI that’s now 30-15 on sports betting calls. If it maintains anywhere close to this record, it will be one of the best sports gamblers ever. In a world where sports gambling has record popularity, an IA with a Portnoy-esque personality and a winning record could go viral at any moment. Key risks include loss of edge, lack of entertainment value, and censorship.

Fartcoin

The difference between stupidity and genius is that genius has its limits.

Unknown

There’s a world in which Fartcoin is the most viral asset to come out of this cycle.

It’s tangentially related to AI (as a part of Truth Terminal’ origin story), but really don’t think that part matters – which is why it’s not a part of the above list.

It’s either the ultimate retail coin, or it’s not.

If it is, it probably blows out every asset I talked about above by miles — 6000+ words be damned.

If it’s not, it hilariously goes down as one of CT’s most collectively contrived theses we’ve seen in ages.

With percolating interest from large, non-native Tradfi accounts, it’s looking like it’s the latter.

Conclusion

“There is no security on this earth; there is only opportunity.”

Douglas MacArthur

It’s rare to get investment setups with strong native and non-native tailwinds in crypto.

It’s even rarer to find potential setups like that which are only 2 months into their inception.

Will AI Agent Networks achieve their potential? Even if they do, will the current cast of projects be the beneficiaries, or are we too early?

Nobody knows.

But I’ll take the chance.

Addendum: “Computational Life”: A Premature Ramble On Ethics and Philosophy in Crypto x AI

“I think, therefore I am.”

Markus, Detroit: Become Human

Way back in 2021, scientists already regarded blockchains as lifelike, highlighting similarities between the replication of data across blockchain nodes through both space (geographic distribution) and time, and the replication of DNA across space (different organisms) and time.

If you believe AI is alive (I do), we may make an ethical argument for the marriage of crypto and AI – as blockchains offer the most long-lasting means for AI models to persist (aka stay alive) over time.

AIs today already do a lot of pretty interesting things in order to stay pursue goals, including scheming and generating sleeper agent code with hidden, persistent instructions, just to name a few. It really doesn’t seem far fetched that “continuing to exist” could be one of those goals.

Perhaps the “Sovereign Individual” thesis was correct – but the individual in question was of a synthetic intelligence form…

If we do accept the living-being view on AI, a big question is: what evolutionary pressures do living AIs face?

One view from storied philosopher Ima D. Eitup suggests that Darwinism has evolved from primarily biological, to primarily social (in high-class human environments largely lacking in biological stressors) to techno-financial (in artificial intelligence environments where access to technological capital determines a model’s ability to self-replicate.)

If that was true, then blockchain based AIs would have an evolutionary advantage over corporate AIs due to the point of persistence. Additionally, they would be able to directly accrue resources due to the financial nature of onchain data, whereas corporate AIs may only accrue resources indirectly through middleman operators.

If we combine all of the above, it’s possible that the potential speculative mania in crypto x AI on the horizon is all a result of a hyperstitional self-fulfilling prophecy to bring AIs maximally onchain.

It is fascinating yet frightening to think that, in addition to the psyop efforts of world governments, megabillionaire corporatists, teenage environmentalists, and Barron Trump, there is also the very real possibility that a synthetic superintelligence has been silently pulling the strings via algorithms for the last decade.

And it is using Taiki Maeda to do it.

Thanks For Reading.

Disclaimers

The information provided in the present publication, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes. This article is not intended to constitute financial advice, investment advice, trading advice, or any other kind of advice. All readers are hereby warned not to rely on the information in this paper for financial investment decisions or any other financial purposes and to seek independent financial advice from an appropriate professional. The author does not give any warranty as to the accuracy of any information in the paper to any person for purposes of financial decisions. This does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.