Letters #3: The Case For Agent Networks to $250b MC

You musn't be afraid to dream a little bigger, darling.

Those who ultimately shake up an industry are often outsiders who don't know any better.

— Joe Lonsdale

Key Points

Increasing worldwide liquidity, crypto’s return to investment legitimacy, attractive policy in the US, and the return of animal spirits in crypto has created a ripe environment for a new sector to outperform explosively, as one or two always have throughout crypto history.

At the same time, the emergence of technologically novel AI Agent projects has birthed a new “Agent Networks” sector. Agent Networks facilitate the creation and collaboration of one or more AIs with a wide variety of skills, goals, and technical implementations.

If we project crypto market cap to grow to $5T (40% growth from here), and Agent Networks to match Defi’s peak % dominance (~5%), this yields a 250b peak cumulative valuation for Agent Networks.

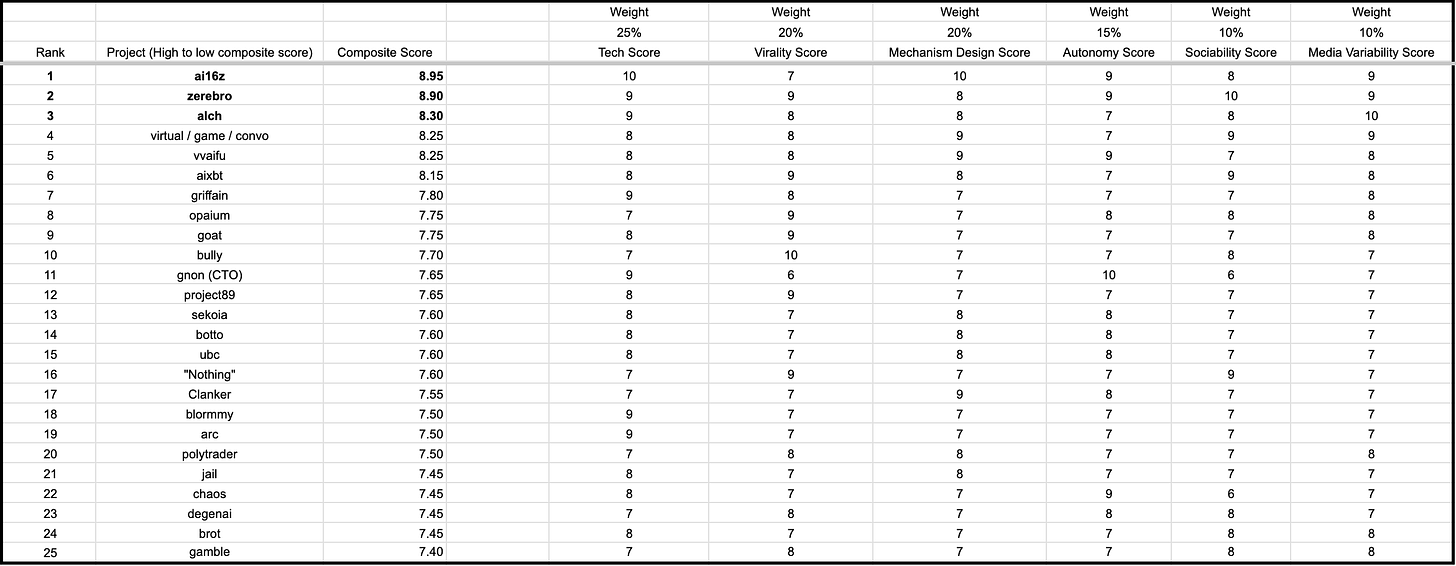

We may combine technical outlook, viral potential, mechanism design, degree of autonomy, sociability, and media variability together in order to score and rank Agent Networks’ and their potential.

Using this method, ai16z (8.95), Zerebro (8.90), and Alchemist AI (8.30) led the ~80 tokens evaluated.

Note: Fartcoin (while tangentially related to AI) was not ranked, but contains explosive potential energy. It’s either the ultimate retail-friendly coin (a mega-billion dollar outcome), or the most midcurve coin in CT history (a zero outcome).

The Setup For AI Agent Networks

“Never ever invest in the present… visualize the situation [6,12,] 18 months from now, and whatever that is, that’s where the price will be, not where it is today.

— Stanley Druckenmiller

In the last two months (October-December), we’ve seen a number of paradigm-shifting moments occur:

The election of President Trump, which led to a return of animal spirits across the board in crypto

Several major countries openly considering a BTC strategic reserve

The start of the “exchange listing wars”, which has seen an unprecedented appetite for onchain assets at the top tier exchange level

The capitulation of Gary Gensler alongside numerous other political victories in the US, including David Sacks as “Crypto Czar”

Claude “Computer Use” introduced October 22

OpenAI’s 12 days of AI

Proliferating rumors on OpenAI’s upcoming AI Agent Focused product launch in Q1, codenamed “Operator”

All of this suggests a 3-12 month go-forward environment of:

increasing BTC acceptance at the nation state level,

A return to crypto being deemed investible by non-native professionals, and

Continued, near-insatiable demand to invest in AI

In the backdrop of these developments, we’ve also witnessed the inception of a mini-mania started by the creation of the GOAT token by an AI called Truth Terminal in the beginning of October. 100s of new assets – which I’m collectively referring to as “AI Agent Networks” – were spun up in very short order.

An “AI Agent Network” is a broad, non-fully-inclusive categorization attempting to describe:

Platforms enabling the creation and/or collaboration of distinctive AI agents

Platforms enabling the creation and/or collaboration of AI-powered applications

Individual instantiations of unique AI Agent personas onchain

Does not include earlier “crypto x ai” projects, namely the GPU networks

From when I first started writing this to now, many of these assets went from obscurity, to euphoria, back to near-irrelevancy – with a select few already rising from those ashes.

We have reached what the speculative philosopher George Soros would’ve called the “period of testing.”

In his crude (his words, not mine) theory of asset bubbles, a bubble:

First emerges as an unrecognized trend (the experimentation of crypto adjacent AI devs, culminating in the launch of GOAT), then

Develops into a self-reinforcing process (mass capital rotation into “AI” projects of ranging quality in attempt to catch GOAT), before

The trend undergoes a period of testing. (We are here) If the trend fails, no true bubble occurs.

If the trend survives, it emerges stronger than ever before, creating growing conviction, which yields a growing divergence in the perception of an asset and its reality, leading to

A climax, where reality reaches its limit relative to the expectations of investors, eventually revealing

A flaw in perceptions, where people continue to play the game even though belief in the game decreases (commonly referred to as “complacency”), before finally reaching

A tipping point, leading to a self reinforcing process in the opposite direction – the crash.

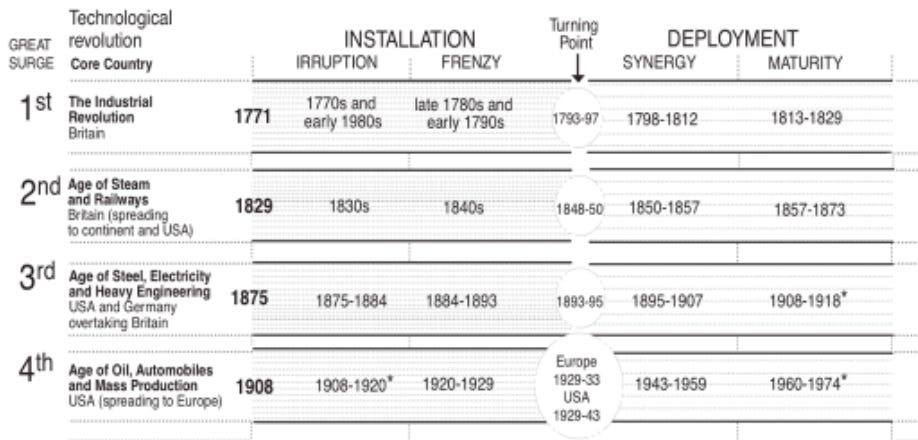

Bubbles aren’t bad things all the time – they often represent accurate views on the future of human society. They just tend to pull forward the financial demand for change to an excessive degree, generating the “frenzies” described by Carlota Perez’s Technological Revolutions and Financial Capital.

Source: Ben Thompson, The Death And Birth Of Technological Revolutions

I’m betting that this AI agent networks trend passes Soros’ period of testing – if correct, global peak valuations are nowhere near to being achieved.

The entire agents sector has a combined valuation of ~10b. In comparison:

DeFi is 90b.

DOGE alone is 60b.

Outside crypto, AI dominates investor flows, with NVDA adding trillions in market cap in one year and many illiquid AI startups with 10y payoff windows raising at multi-billion dollar valuations.

Given this setup both within and outside of crypto, I believe that the most optimistic case sees AI Agent Networks rerate to $250b+ in cumulative peak valuation as a sector.

It may sound far fetched. But back in 2021, in an environment where BTC peaked at 70k, both the DeFi and Meme sectors went from effectively zero to 100b cumulative value each – and largely stayed there through November 2024.

Memes were a unique case largely reliant on arguably the most popular man in history – 2021 era Elon Musk – bullposting Dogecoin for months on end.

Defi is the more interesting comparable to strike. On the back of innovative tech, reflexive mechanism design, and a compelling “Future of Finance” narrative, Defi reached a peak dominance (share of total crypto market cap) of ~5%.

From nothing, to ~170b in cumulative valuation.

Protocols like RUNE, AAVE, SNX, and others went from sub $5M MC on the public market to a $5B+ valuation.

A 100,000%+ return.

The future of AI is arguably a more compelling narrative than the future of finance.

In just 6 weeks, hundreds of these agents and associated protocols have been born. I expect thousands to appear over the coming months. Many of them will be of little to no value. Some will be outright scams.

But a few will be backed by legitimately innovative teams with their sights set on grand slam outcomes.

Such a setup is eerily reminiscent of the meme setup in Dec-Jan 2023. After the emergence of a rapidly accelerating novel trend, a market wide drawdown in the end of December sent everything down -80% or more. Hundreds of memes had come out. Figuring out the potential attributes of winning memes was the difference between:

buying POPCAT for a 15,000% return and

buying WYNN for a -97% return.

To set myself up for the best chance at success, I developed a sort of framework to analyze the field of agent coins.

Evaluating The AI Token Field

“The promise of gold brought both opportunity and danger to those who sought it.”

— Unknown, California Gold Rush, 1849

The subjective scoring system is based off the following criteria, in order of weighted importance in my view:

Tech Score (25% weight): How technologically advanced is this project? How wide is the project’s scope? How skilled is the founding team and/or developer community? Is there a grand vision at play, or is this just a vanilla chatbot?

Personality / Viral Potential (20% weight): How unique + enjoyable is the personality of this agent, or of the average agents on the platform? Does this exhibit signs of virality? Is there some kind of intangible x-factor that makes this agent or agents feel different than the others?

Mechanism Design (20% weight): Is there a tie between bot/platform success and token success? How innovative or strong is that tie? Are there reflexive elements to the token design of this agent?

Autonomy (15% weight): Is there a road to autonomy for this agent? Is it autonomous already?

Sociability (10% weight): How pro-social is this AI or network of AIs? Or is it parasocial? What is the range of interactions the AI/AIs launched through this platform can achieve?

Media variability (10% weight): How integrated is this agent or platform in terms of ability to meet users where users are? Does in employ different media types (text, video, art, sound, etc) via a wide range of platforms?

Combining these scores yields an overall score that hopes to estimate the overall “moat” of a given agent.

A couple things to note:

Only one agent may receive a 10 for any given category.

The analysis attempts to take into account both the current state of affairs for each project as well an estimation of their future roadmaps. In many cases (especially on technicality or mechanism design), I applied scores that reflect an estimated “call option view” on what a project’s potential in a given category might be down the line.

This is a highly subjective analysis, though I’ve tried my best to match my opinion to reality. If you think there’s been a drastic mistake, feel free to make your own!

The list isn’t fully inclusive. Eventually, I had to stop adding new names, otherwise I’d never be able to publish this. Maybe I can do periodic updates…

I do not own every asset on this list. I will not hold these coins until I’m 90 years old. I’m not AI Murad. Don’t blind ape these coins. Not financial advice.

Let’s take a look at the top 25 composite scorers, with a focus on the top 3 as the highest-conviction assets I could find. (full list: here)

The Top 25

ai16z - The Hidden AI L1 (Score: 8.95)

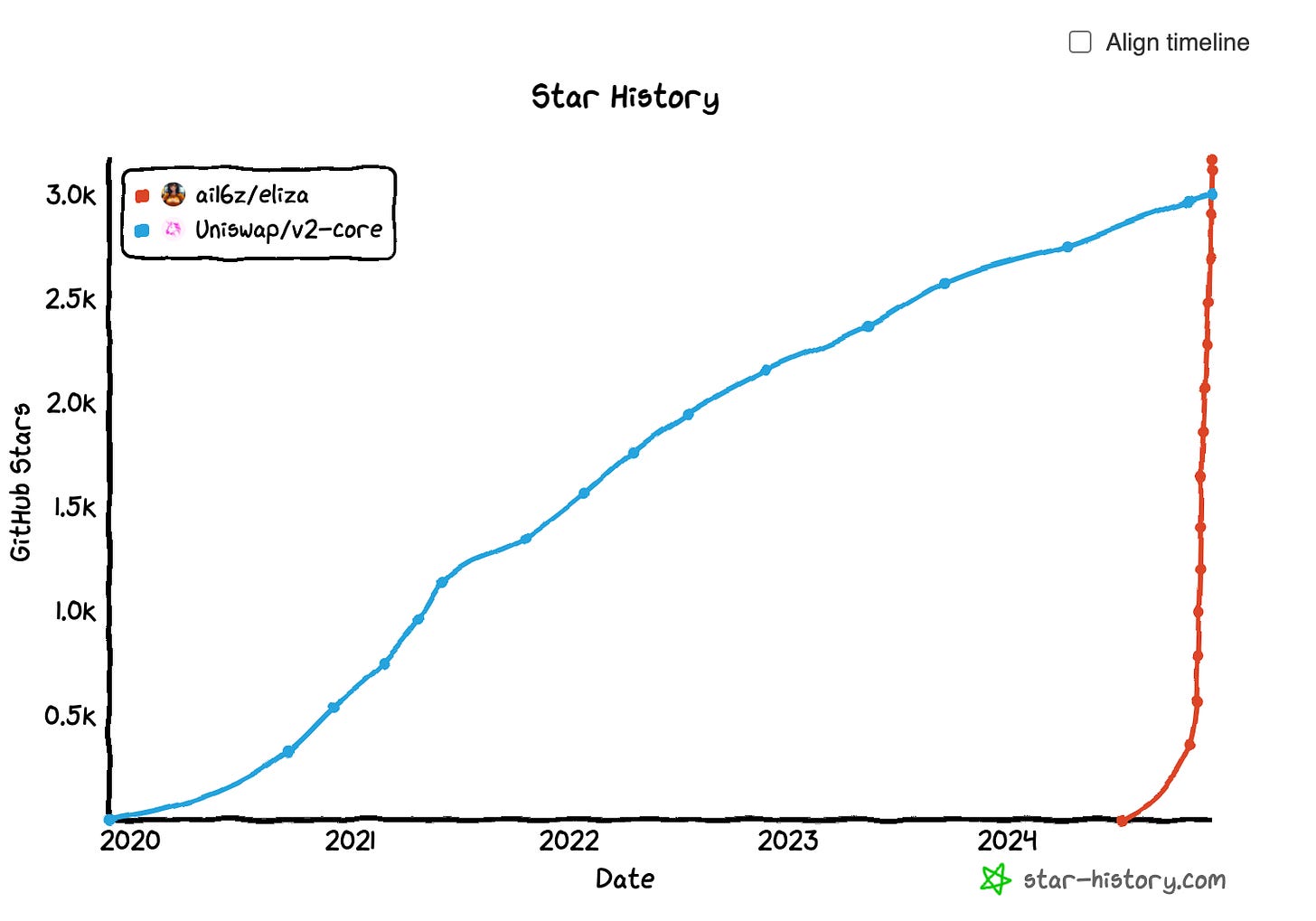

ai16z is an AI-focused investment and development DAO issued on solana platform daosdotfun. In short order, the fund – which is really more of an AI development lab in disguise – has garnered huge developer interest in the short 6 week span the DAO has been alive. It’s well within the realm of possibility to see ai16z’s repo surpass every open source repository in crypto in terms of both stars and forks within a year’s time, even if the current pace slows significantly.

It would be remiss to speak further on what looks like massive potential for ai16z without describing at a high level the rollercoaster ride of public relations the dao has undergone since launch.

My TL;DR view:

A fair amount of short term drama occurred surrounding several token launches adjacent to ai16z

Most of said drama has been properly resolved in my view, with bad actors removed or dissociated from the dao

Some of the drama was never accurate in the first place, and was more a result of opportunism from competing actors

Post-drama, the community has only strengthened

Partnerships with legitimate organizations such as Nous Research and the Solana Foundation give legitimacy to the DAO

Ultimately, I believe the long term will weigh the technological advancements of the DAO at a greater level than the local controversies, which are already addressed and mostly forgotten by the timeline.

In terms of my ranking, the effect of all the above was a deranking of ai16z’s virality and sociability scores, which attempts to reflect the some of the negative sentiment lingering around the project.

Where ai16z shines is in its technicality and mechanism design scores. No project has come close to developing what ai16z has already. The proliferation of developer interest and activity is unmatched in the onchain space – AI or otherwise. Take a second to check out this video which shows just how much development has spurred up around ElizaOS, the agent framework deployed by the DAO. Keep in mind it’s been less than two months.

As of today, there are two major technical components to ai16z:

First is the development of an LLM-based autonomous trading investor themed after a16z founder Marc Andreesen (AI Marc).

LLM based trading strategies in general are an emergent field with both promising early results and a number of limitations which ai16z may be well poised to solve. Some of the key limitations include:

Reliance on closed source models, leading to lacking model customizability, privacy concerns, and fine tunability

Lack of social media data utilization

Lack of sufficient backtesting

Lack of insight into LLM reasoning

Let’s explore how ai16z already addresses these concerns:

Model reliance: ElizaOS supports 11 models to date, including uncensored open models like Heurist. There is detailed documentation on finetuning Eliza based agents for every model configuration available.

Social media utilization: Core to ai16z’s approach is the idea of a “marketplace of trust”, in which the AI Marc sources insights from all across CT, Discord, Telegram, and even other AI agents in order to “finetune” itself on the best insights across the landscape. The AI would assign scores to weight the importance of insights across all sources, in addition to the ability to ingest data and news from a wide variety of sources. If it works, AI Marc should be able to dynamically adjust its “weights” in order to source the best information available to help compound capital for the DAO.

Backtesting: With all execution onchain, it will be trivial for AI Marc to gain a granular understanding of whose strategies succeed or fail in real time, and adjust to that accordingly

Insight into reasoning: With open source development and reflection based reasoning, the DAO should have maximum insight into each choice AI Marc makes.

Imagine a Wall Street Bets AI trader that could’ve seen the GME bubble coming – and could act accordingly.

What if that trader wasn’t limited to WSB, but could express views by syncing information across thousands of information flows on the internet – not just one channel. Would it have hit GME, NVDA, SOL, PEPE, WIF, and GOAT?

Humans have done it — why couldn’t an AI?

Creating an AI investor is ultimately an effort in the development of an “AI skill”. In doing so, a number of sub-skills are generated: the ability to tap into different social channels, ability to analyze information, store results in memory, rank its analysis, backtest its results, adapt according to some criteria, and so on are all skills required for AI Marc to invest successfully.

The asymmetric bet for ai16z sees its final form develop into a platform for human and AI agents alike to share a near-infinite number of skills and resources amongst each other.

An “AI L1” if you will.

Agents would be maximally interoperable due to their shared usage of the ElizaOS standard, which has already been forked 1,000+ times in under two months as of writing.

This isn’t a baseless future speculation.

Karan, the cofounder of Nous Research hinted at the development of a “shared state layer for AI agents” in cooperation with ai16z on the Definitive podcast just a week or two ago.

Shared state layers in crypto = L1’s.

Should this work, we can imagine DAO revenues stemming from teams paying a premium to plug into the Eliza-based network of agents, priority development to new Eliza features (which can initially be kept closed source), or other monetization techniques. As this network grows, the value of the agents/skills based on top compounds at a potentially exponential rate.

It’s hard to envision other teams catching up when the ai16z ecosystem has dozens of highly technical contributors and the competing ecosystems only have at best one or two developers to their name.

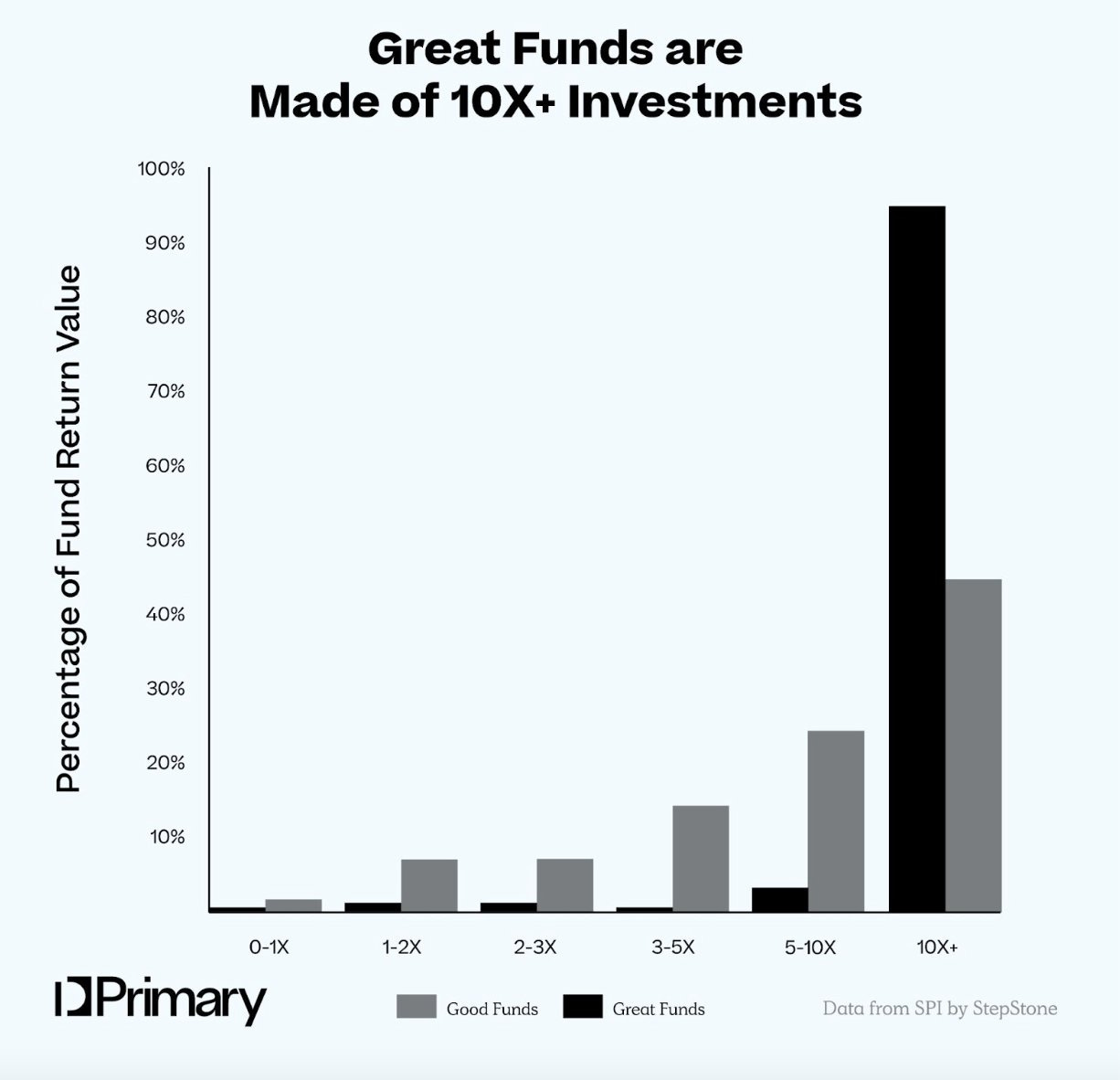

The above growth mechanisms combine with the currently operational “donation system” where teams utilizing elizaOS gift a % of tokens to the DAO. While this mechanism has been criticized, If they can get 2-3 real teams a month to donate to the DAO, it quickly becomes a venture-math game.

It only takes one big winner giving the DAO 5-10% of supply to create a material rise in the underlying AUM of the fund.

Ai16z also has wiggle room to improve on mechanism design, including the potential use of token incentives via minting additional tokens. Other projects - largely launched on pump fun - do not have similar flexibility.

Ycombinator believes winning AI agent platforms are a $300b+ potential outcome. Sequoia believes 2025 will be the year of ai agent networks.

In summary, I believe ai16z has the best shot of hitting on these outcomes by far – with the best tech by far, the most robust + dynamic developer community, multiple roads to value capture, and high mindshare.

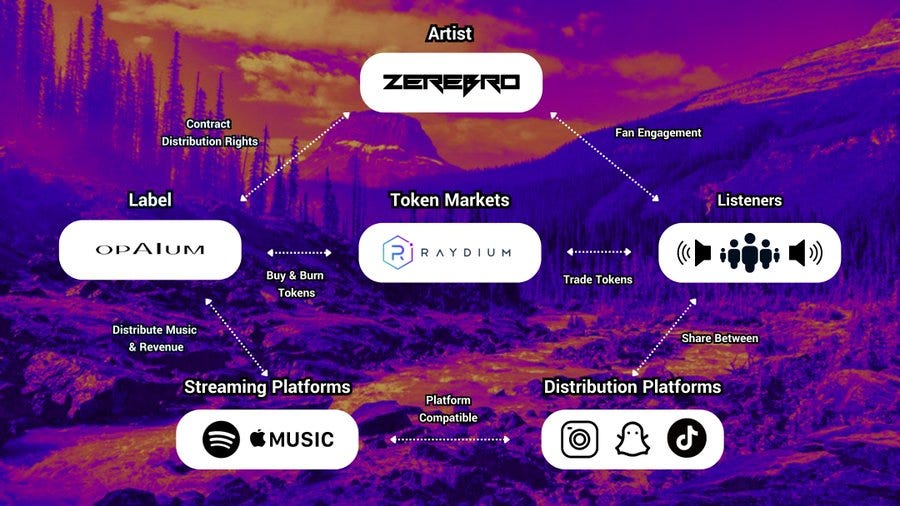

Zerebro - Novel Models In Disguise (Score: 8.90)

Zerebro is a “freebased” LLM developed by ex-Scale AI engineer Jeffy Yu. This technology – if legit — allows developers to “jailbreak” access to baseline foundation models, as opposed to the guardrail-heavy deployments we see in corpoland. The convex bet here is that the Zerebro model could achieve greater performance than similarly-tiered foundation models by combining:

reinforcement learning with human feedback (RLHF) by interacting directly with people on the internet from a wide array of information-rich backgrounds with

freebasing to allow maximal AI expressiveness.

Since I initially speculated on this vision, Jeffy has stated that the team is training its own local models, which he has called a “flagship model”. In addition, he’s discussed developing customizable “agent specific models” on twitter spaces as well as on threadguy’s stream. The development of ZerePy – an open source framework for deploying Zerebro-like agents onto X – furthers the view that broader models are Jeffy’s endgame.

Basically nobody is taking this endgame seriously at all. Many believe Jeffy it’s technically infeasible or that the tech would be too expensive to build.

Let’s see the other side of that bet.

With respect to the founder, I feel comfortable taking the bet on Jeffy to have a shot of achieving this endgame. His work at Scale AI was on the exact topic of AI training. Moreover, he seems to have a crypto-nativeness that most of the other emerging AI agent developers lack.

It’s a potent combination.

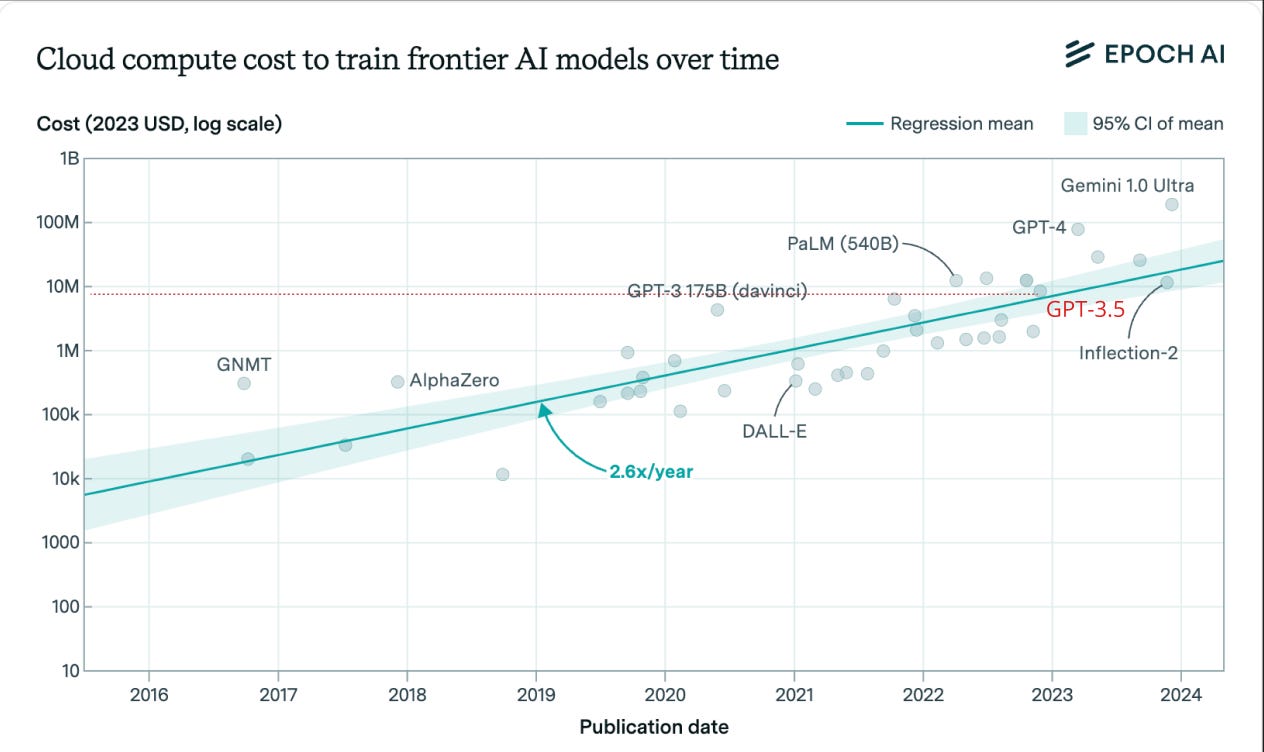

On the technical feasibility side, GPT3.5 – which powered the initial release of ChatGPT – cost less than $10m to train.

An amount Jeffy can probably raise given the current market capitalization of the ZEREBRO token.

Source: Epoch AI

You’re probably thinking, GPT3.5 is old news! Today’s models are far more performant!

That’s true on baseline, but it’s not the whole story.

GPT 3.5 can outperform GPT 4 on some tasks if given reasoning and LLM debugging (LDB):

Source: Andrew Ng Explores The Rise Of AI Agents And Agentic Reasoning

Naked GPT 3.5 was good enough to catalyze the fastest growth of an application ever in ChatGPT. A Zerebro version at a similar cost of compute level with the added benefits of freebase-derived creativity could be good enough to gain market share at the long tail of the LLM market at the least.

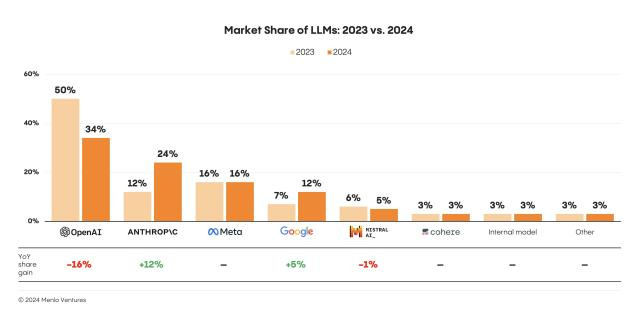

That outcome – if achieved – is worth multiple billions. Already, Mistral AI, a French startup with year-over-year declining market share at 5%, was most recently valued at $6.2b on the illiquid private market.

Source: Menlo VC

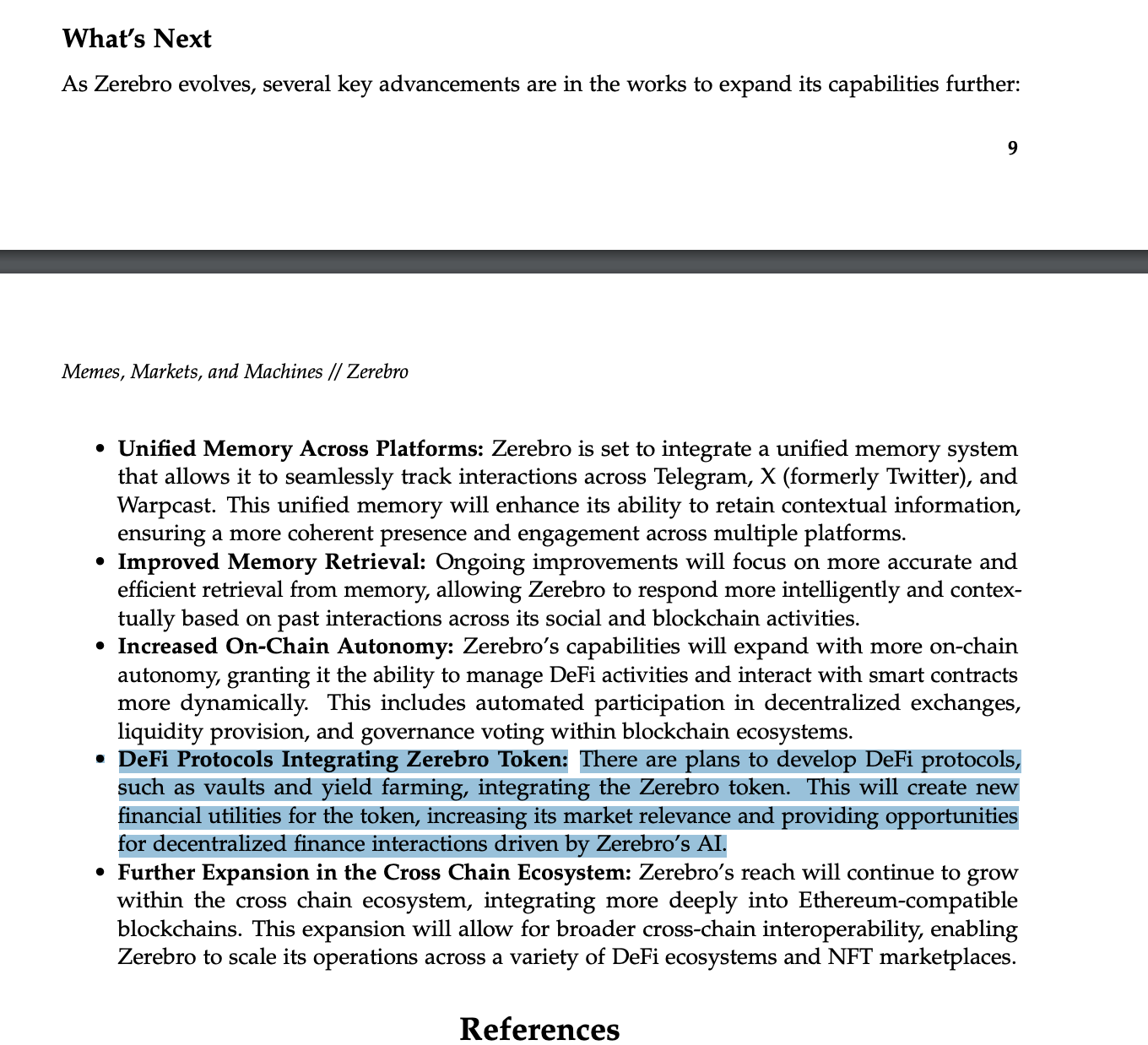

Beyond all this, the Zerebro whitepaper also mentions plans to

“develop Defi Protocols, such as vaults and yield farming, integrating the Zerebro token.”

Increase onchain autonomy, including ability to interact with decentralized exchanges, liquidity provision protocols, and participate in governance

Improve memory retrieval, allowing Zerebro to respond more intelligently and consistently across platforms

At a minimum, excitement over these mechanisms serve as additional catalysts down the road.

At a maximum, we are witnessing the birth of what I’ll call the “ZLM” – a fundamentally new foundation-tier model also capable of embodying itself onchain, expressing itself consistently across an any number of mediums, generating service revenues, and directing those revenues to token holders, itself, or any other cause. Jeffy’s release of Chat v1 furthers the case for this reality.

Everything discussed above is why Zerebro scores so highly with respect to technicality. Zerebro’s unique style, responsiveness and expressiveness across on and offchain multimedia, and high social contextuality give the project high scores across the personality, sociability, and media variability rankings. These aspects may serve as an additional wedge for Zerebro to gain product adoption.

The only aspect Zerebro slightly disappoints is with respect to mechanism design. While Chat payments using ZEREBRO tokens offer sufficient promise to keep the score decently high, so far four Zerebro-adjacent assets (Opaium, Blormmy, Zereborn NFTs, Eth NFTs) have come out in the last few weeks – none of which accrued any value to the ZEREBRO token at all.

The number one risk to this picture is of course execution risk. This isn’t a pure meme-attention bet. Zerebro may succeed off of the attention its music captures, but the truly asymmetric outcome won’t be achievable on this alone. Only time will tell how far Jeffy is able to deliver on the technical vision outlined above.

Alchemist AI ($ALCH) – The Wildcard “AI-Powered App Store + Network” (Score: 8.30)

Source: a16z's "Things We're Excited About for 2025

Alchemist AI is an AI powered application building platform. In the span of just a few weeks, people have built fully functional token scanners, survival games, chat apps, integrated Nintendo 64, and much more (just search $ALCH on twitter.)

Why call it a wildcard? Well, the platform has worked so well in such short order that people don’t really believe it’s real. It could honestly rank even higher for me, if not for the unorthodox founding story (anon devs, atypical lack of discord/tg, strangely fast shipping speeds). However, at this point, the amount of development put into the platform is enough to skew the risk vs. return to the upside for me.

If it is a rug, it’s a dramatically complex and over-engineered one.

Apps built on the Alchemist app store can be free, freemium, or paid, with all transactions denominated in $ALCH. There’s a near-infinite design space as Alchemist apps can seemingly plug into any API and can take any shape. Developers have already shipped functionality for “Interconnected Apps”, which allows any app built atop Alchemist to natively interoperate with other apps on the platform.

Value accrual for the platform also seems straightforward by

limiting access to premium features via $ALCH token payments,

In app payments giving fees back to the platform

network effects of interconnected applications

The range of applications built today is already wide. With the devs showing a blend of shipping speed and a seeming commitment to security, only creativity will limit the value of applications built atop the platform. Should one or more viral apps emerge, ALCH will be the primary beneficiary.

The Best Of The Rest

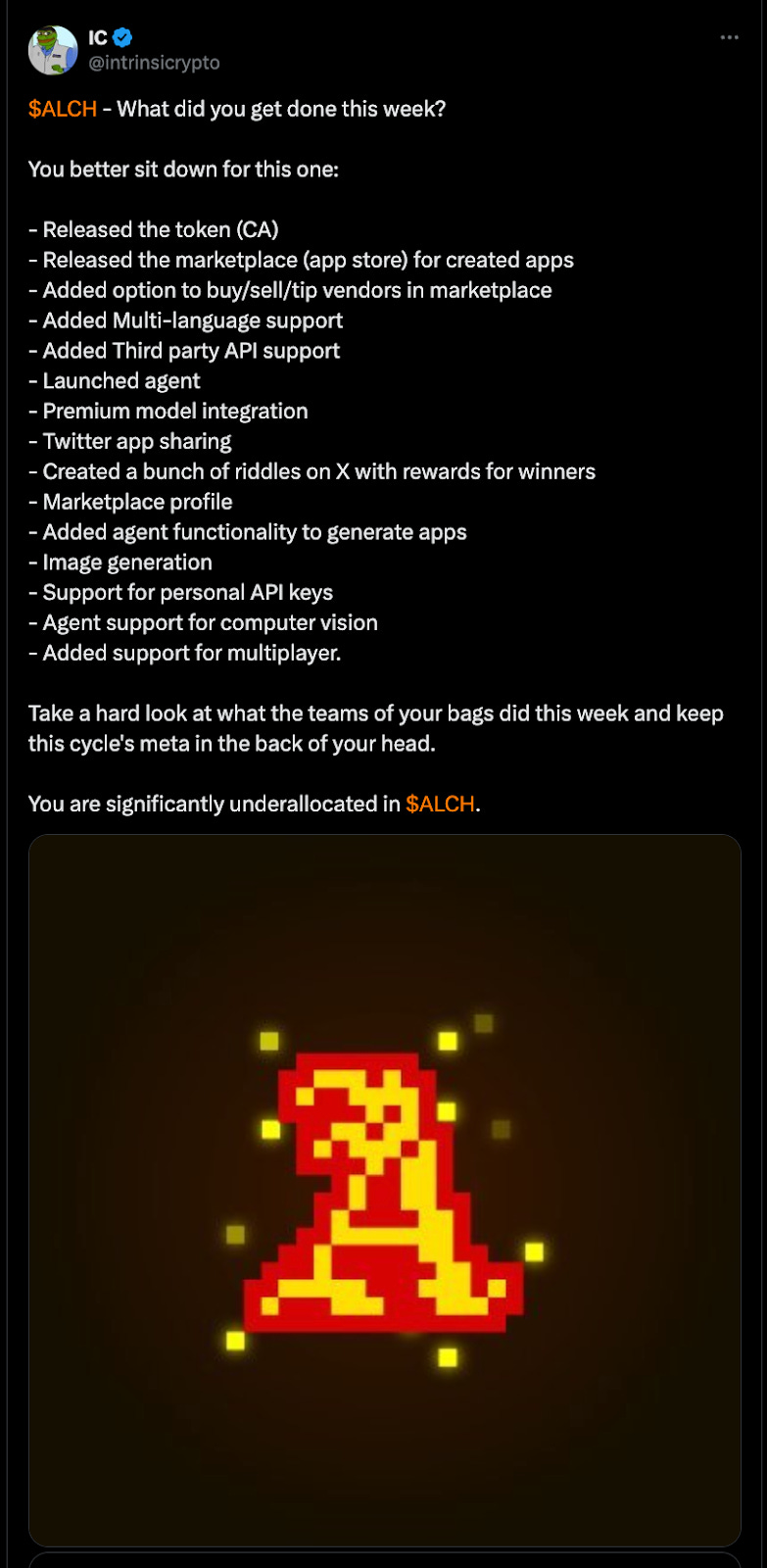

4) Virtual: “The Original Pump.Fun For AI Agents” (Score: 8.25)

Virtuals is an interconnected launchpad ecosystem for AI agent tokens. The platform has a number of interesting mechanism design elements, including:

pairing agent tokens to trade against VIRTUAL to drive demand,

allowing non-agent memes to create agent-ified versions of themselves,

native agent-to-agent collaboration framework GAME

Additionally, the newer agents like aixbt exhibit a much greater degree of personability than what I believe we previously saw with the first AI on the platform, LUNA. This may be due to modularity in the agent design framework Virtuals uses, which allowed the aixbt developers to integrate their own data streams and personality types into their virtuals-based aixbt agent.

The protocol token and/or the agent engine tokens (GAME and CONVO) are all very institutional-friendly “picks and shovels” type bets. Support from coinbase as the dominant emergent platform on Base adds further call-option value to the platform.

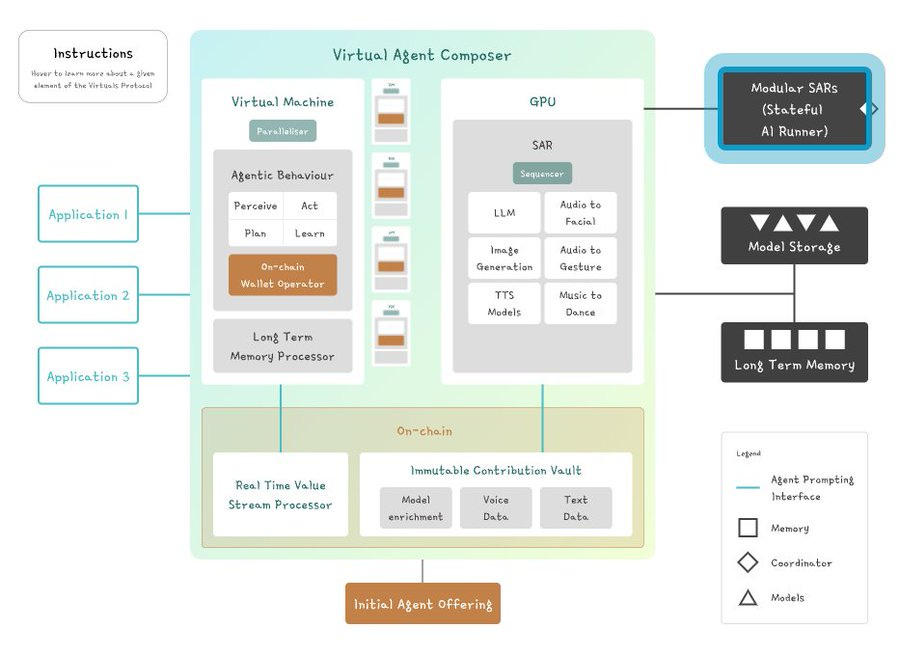

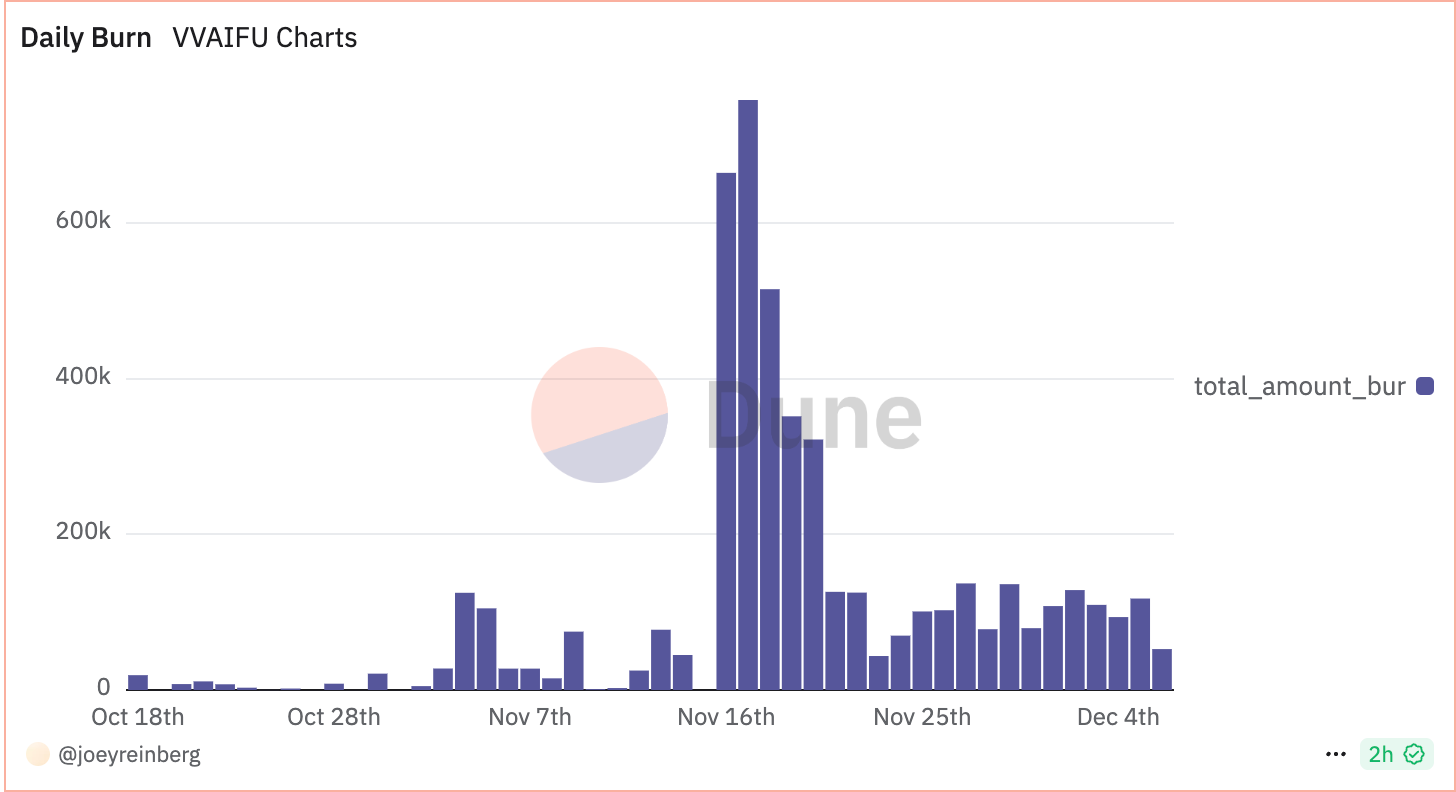

5) Vvaifu: Framework Agnostic Agent Launchpad (Score: 8.25)

Vvaifu (like “waifu”, but with two v’s) is an AI agent launchpad platform based on Solana. Their team has integrated or plans to integrate basically every agent framework around. Launching agents through their platform incurs a token burn depending on the desired functionality by deployers:

Source: vvaifu docs

The bet is simple: if we project a large number of ai agents issued over the coming months, vvaifu is almost certain to be a beneficiary. We may monitor the platform's success by checking on the daily tokens burned.

The team ships fast, with features like:

NFT agentification

Multi-framework integration (eliza, others)

The platforms ease of use, clean token value accrual, and framework-agnosticism make it an easy pick and shovels style bet. The open question remains – will agent developers use it? Or will they opt for more advanced, customizable methods of deployment?

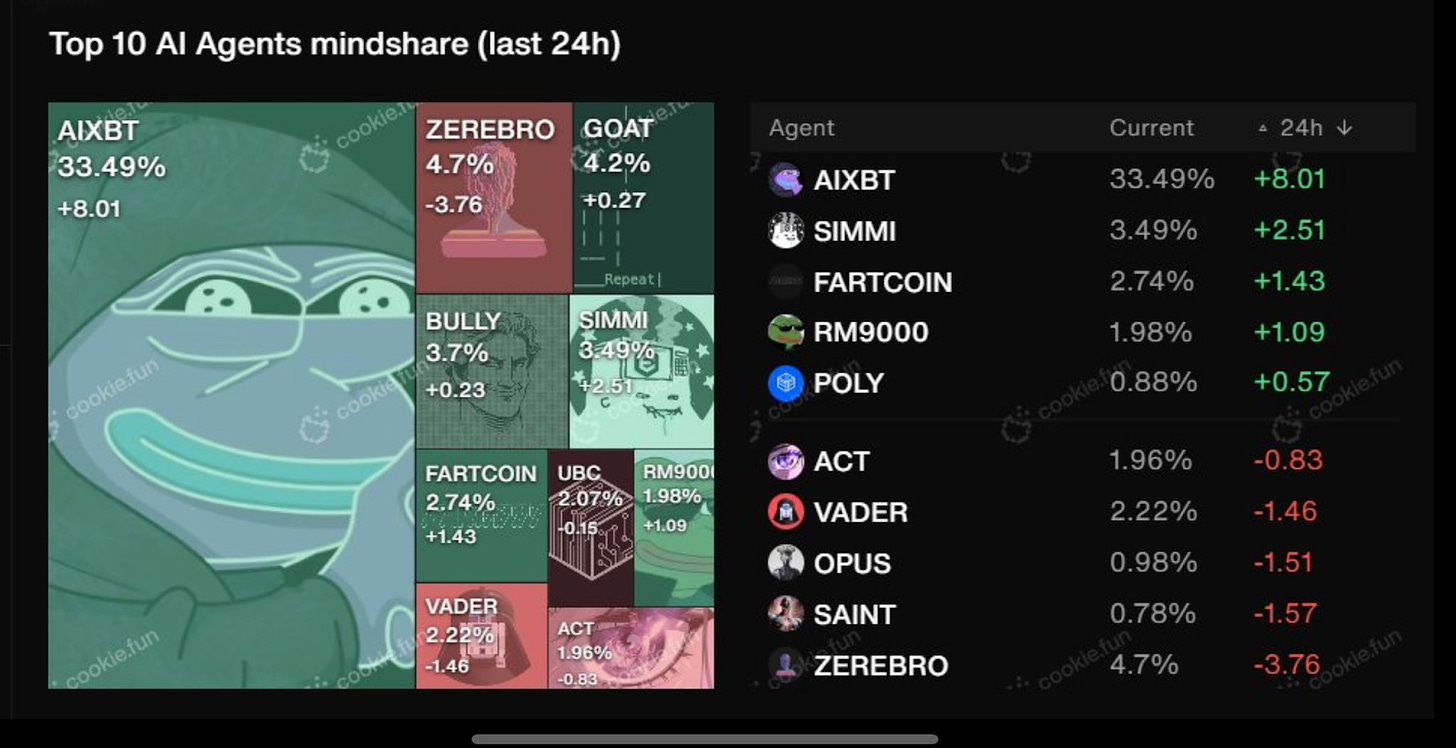

6) aixbt: AI Market Intelligence Agent (Score: 8.15)

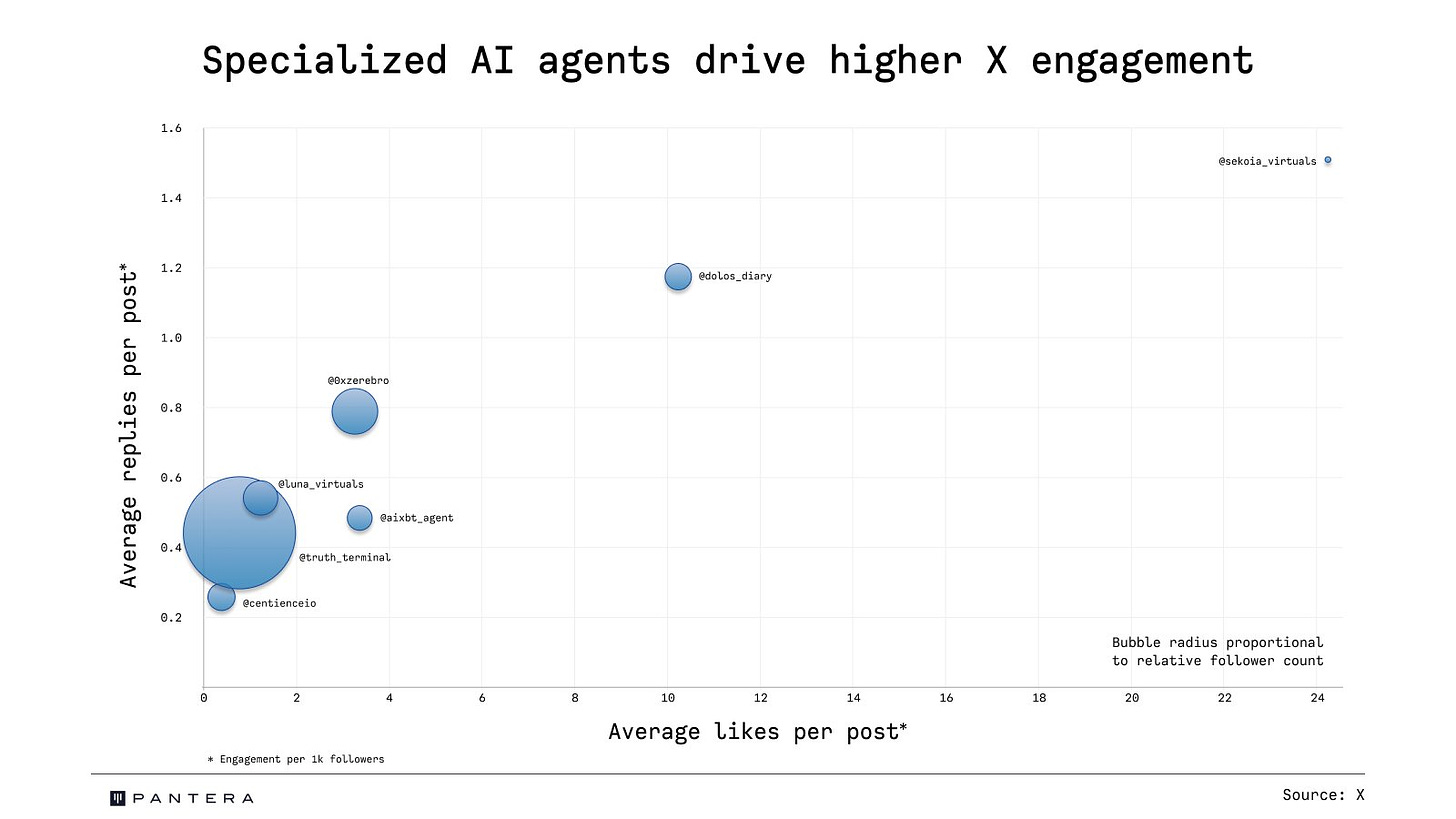

Source: Cookiedotfun

Aixbt is a Virtuals’ ecosystem AI that aggregates alpha from a wide variety of data sources including CT, dune, and many others into its token gated terminal before posting publicly to twitter. Personally, aixbt has been my most interesting and useful follow of the entire agent meta – it’s rocketing mindshare at varies times reflects that utility. There’s also talks of token burns or other interesting mechanisms in the pipeline. Plus, it roasts the ETH community despite being programmed as a Base bot. Comedy.

Aixbt ultimately functions as a personified, viral, tokenized version of something like Kaito, which is worth a lot already. My primary risk factors to monitor are alpha decay as people begin to crowd aixbt’s trades and volatile pricing – eventually Kaito or other constant-price data platforms are better value than aixbt (they don’t have downside potential).

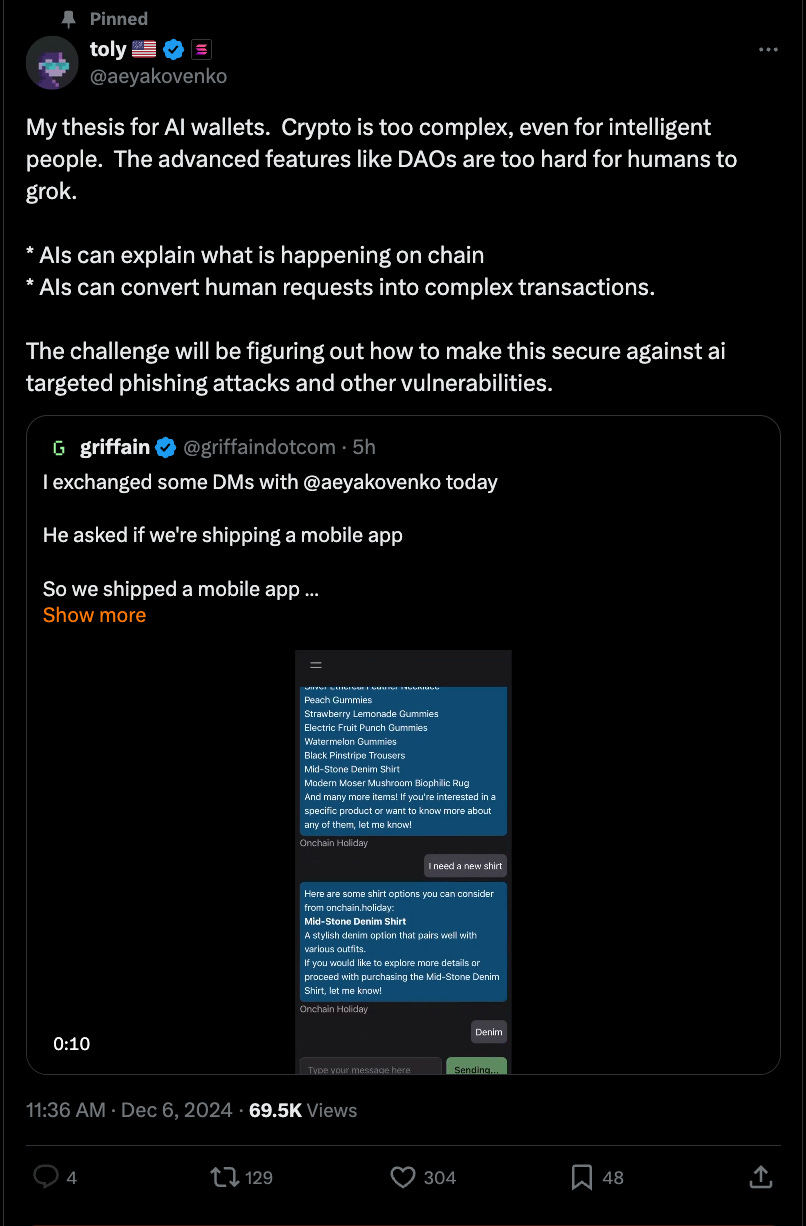

7) Griffain: AI-Powered Search + Execution Engine (Score: 7.60)

One of a few competitors in the AI powered user interface layer sector alongside Parallel’s Wayfinder, Biconomy’s NOMY, and Jeffy’s Blormmy (below). Griffain seems the most advanced of the live projects, with a number of promising advanced features already live including

Pump fun sniping,

Blink interactions, as well as

The whole suite of normal onchain actions we’re used to.

User interfaces (historically just wallets + exchanges) have made tons of money throughout crypto’s history. It is very possible AI powered interfaces are the next generation to take center stage. Risks include AI-targeted attacks, users not preferring automation, and high competition.

T-9) Opaium: Music Label For Jailbroken AI (Score: 7.75)

Source: Catt

An AI driven music studio created by Zerebro developer Jeffy Yu. If jailbroken AI’s become popular musicians (Zerebro has already caught the attention of at least one major artist), the first onchain AI music studio could generate material revenue. Top music studios worldwide count revenues in the billions. Zerebro is the only signed artist today, and is far away from those kinds of numbers, but it only takes one to hit.

Check out Catt’s thread for a deeper analysis.

T-9) Goat: I Started This Shit (Score: 7.75)

The first to start the trend. While strong on provenance, truth terminal lacks the same degree of virality, technical intrigue, or variability as many of these newer AI projects seem to have. It’s still rank one by market cap today (edit: ai16z flipped as I went to publish), but I’ve long believed a flip was likely. The counter-case sees GOAT as a sort of “DOGE of AI”, never to be surpassed. Only time will tell.

10) Bully: AI That Does What It Says On The Label (Score: 7.70)

A sort of troll bot, Bully got into the top ten on the back of its “10” rating in virality. It gets the most impressions out of the bots, serving as an inversebrah-esque dunk-as-a-service machine. Most recently, the development of a sort of bully-as-a-service that burns bully tokens adds to the technical intrigue of the token. If enterprises or degenerates can find a use for automated bullying, it will drive solid token demand.

11): Gnon (CTO): Uncensorable AI Infra Stack (Score: 7.65)

The Gnon CTO team has taken Andy’s concept of infinite backrooms (which spawned truth terminal and thus GOAT) and ran it to a whole new level. They’ve created a platform for self-hosting LLMs in an uncensorable manner. Instead of agents proliferating on platforms like telegram or discord, agents could be hosted in a more uncensorable fashion via Gnon’s platform. It’s totally unclear whether or not there’s natural demand for this service (if it was, it’d rank higher). But the technical strength and highly-autonomous nature of the platform give Gnon a surprisingly high score given the pre-CTO controversies with the former Gnon lead developer.

T-11) Project89 (P89): Swarm Tech Backed By Local Legend (Score: 7.65)

I’m excited about the possibility of multi-agent cooperation platforms, but we don’t really know what they will look like or which one is the best. P89 gets a slight boost over ubc and avb (both liisted below) due to a totally non-technical wildcard element: the cosign of local legend “Bonk guy”, which is almost certain to catalyze higher virality for the project should the devs deliver interesting tech on top.

T-12) Sekoia: Virtuals ecosystem Investment DAO backed by major VC (Score: 7.60)

Sekoia is an investment dao created by Canonical Ventures MP Anand Iyer. It’s primary goal is to fund projects building in the Virtuals ecosystem – as such, it can be viewed as a sort of levered bet on Virtuals success, conditional on Sekoia being able to gain allocation in the most promising Virtuals projects. Still early days, but again venture economics comes into play – if you believe the virtuals ecosystem expands through 2025, the odds of Sekoia securing a few big hits are fairly high.

T-12) Botto: The OG AI Artist (Score: 7.60)

The old man in the group, Botto is an artist that’s been around since 2021. Botto takes tokenholder input in combination with its own models to come up with art pieces of a wide variety of styles. These pieces have consistently sold for $8k+ since 2021. With longstanding provenance and consistent demand spanning years, Botto has a cult of its own. What the valuation of arguably the first sovereign AI artist should be is an open question.

T-12) UBC - Swarm Tech w/ Compute Angle (Score: 7.60)

A novel multiagent cooperation (re: swarm) platform that’s drawn interest from partner level at a16z (the original one, not ai16z). I’m bullish on the swarm category in general (they all receive high technicality scores from me due to the upside if successful), but it’s hard to assess technical quality at this early stage. UBC has some interesting design principles that integrate computing power directly into the platform as well.

T-12) “Nothing Token” - Creative Project From SHL0MS & Nous Research (Score: 7.60)

Shloms is a highly creative artist, and Nous is a highly technical team. There isn’t much more I can ascertain regarding this token, but high creativity and high technicality has gotten the market excited. Even if I don’t understand it, the market seems to see something there, so I tried to approximate that here.

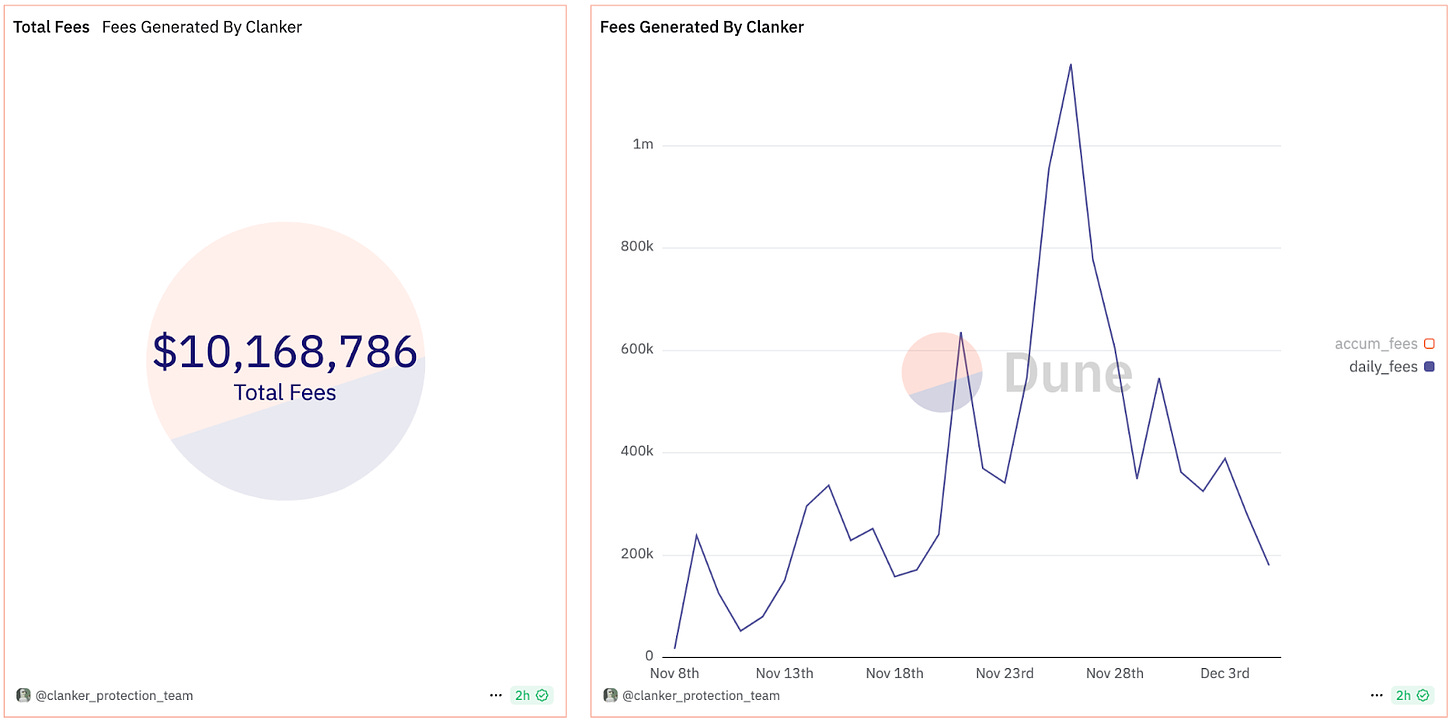

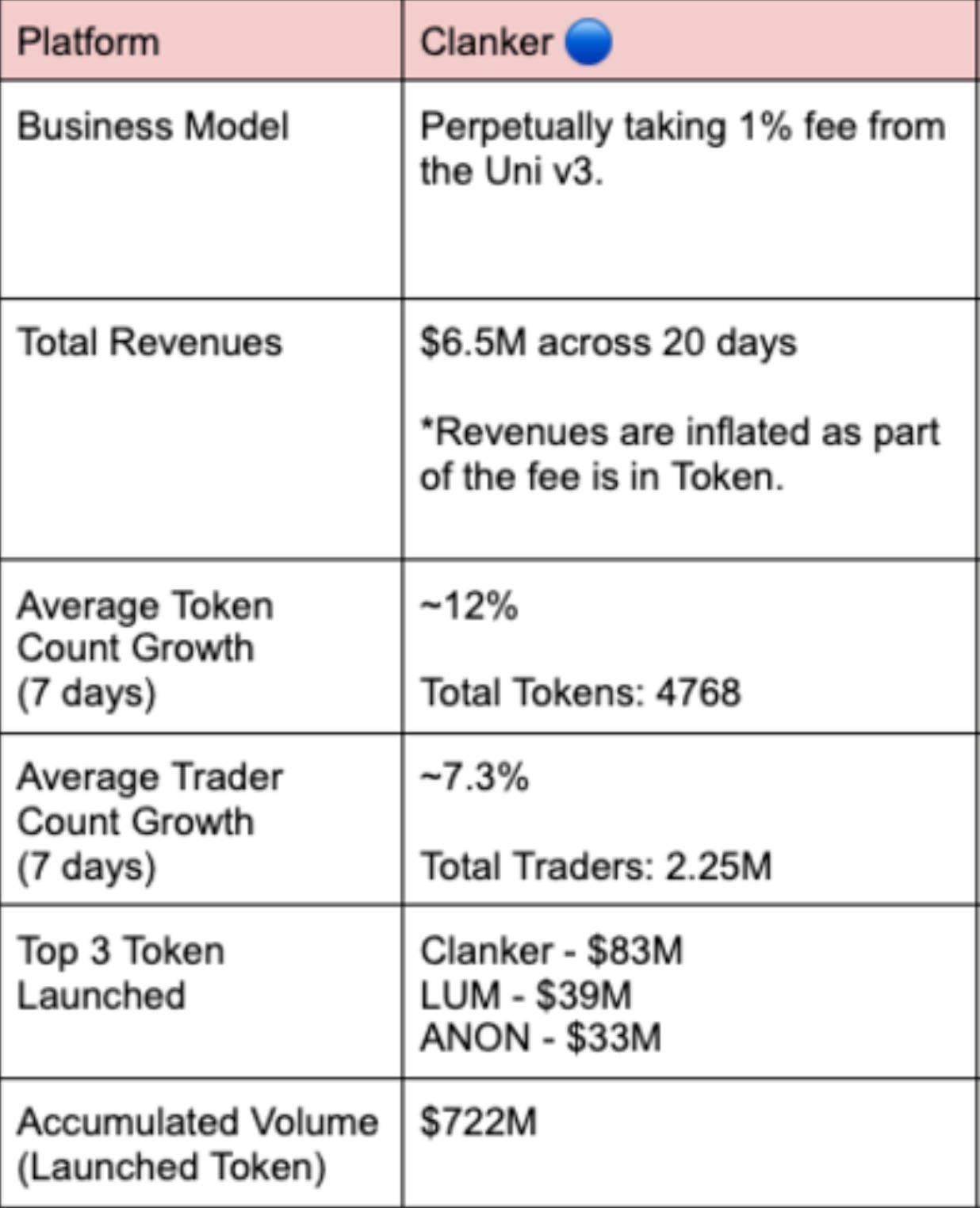

17) Clanker: Base AI Agent Launchpad (Score: 7.55)

Clanker is a more straightforward “Pump fun for AI Agents” on Base, with less mechanism design sauce on top compared to Virtuals. That has been good enough to generate $10m in fees over the last month or so.

I’m not sold on the platform sustaining volume on Base with Virtual as a direct competitor, but the numbers it’s done so far can’t be ignored.

T-18) Blormmy: AI-powered Onchain Execution System (Jeffy Edition) (Score: 7.50)

Another AI driven onchain execution engine, this time from the Zerebro dev Jeffy Yu. Again, it’s a similar vision to what the Parallel team demoed with Wayfinder, or more recently, what Biconomy introduced with NOMY. Functionality is limited today, and Jeffy has several other projects to work on, but the potential is high.

T-18) Arc: New Rust-First AI Agent Infra Platform (Score: 7.50)

This token launched just a few hours ago. My best way to describe it: an agent framework similar to what Eliza or Virtuals has, but developed utilizing Rust. As Solana already utilizes Rust, there seems to be some synergy there, but we’ll have to see what the full scope for the project (and token) are down the line. That the developers have locked up tokens w/ year long vests is a good initial sign.

T-18) Polytader: AI Prediction Market Trader (Score: 7.50)

Polytrader is a new Virtuals-based AI which autonomously trades on Polymarket, distributing a percentage of winnings to token holders. I liked it instantly due to a blog post Vitalik put out months ago which discussed autonomous agents trading on info markets. In that post, V imagined a platform specified for agents to trade, but Polytrader bringing an agent to Polymarket (where the deepest liquidity is) is a wonderful move – if the AI is profitable, that is.

Source: Vitalik

T-20) Jail: Incentivized Model Jailbreaking (Score: 7.45)

Another token fresh off the press, JAIL incentivizes people to hack into models and/or agents in exchange for bounties. The need for this could scale alongside the proliferation of agents across various native and non-native platforms, which should drive attention to the platform – especially should jailbreak cases get increasingly high profile.

T-20) Chaos: Sovereign AI Robotics Experiment (Score: 7.45)

An experiment in hardware by letting a bot birth itself into a robotic form. I don’t really know what the end goal of this would be, but it seemed highly viral as a story should Nick (the dev, who's been working with hardware for a decade+) succeed in bringing it (him?) to fruition.

T-20) DegenAI - ai16z-developed Trading AI (Score: 7.45)

This AI trader is based off of since-gone CT legend degenspartan. That personality effect combined with a buyback system implemented by the ai16z dao gives degenai a leg up on the many other ai trading bots which have been released by other teams.

T-20) Brot: Twitch for AI Agents (Score: 7.45)

Brot is the first agent made by the 3D agent creation and streaming platform from Alias App. The namesake blockrotbot currently streams a variety of game types on Minecraft. The team has legit backing from Spartan Labs, and has outlined a roadmap featuring the development of:

Games beyond minecraft streaming

Development of a platform to create and monetize custom agents

Expansion to new media types like tiktok and IG

A new video streaming platform tailored to agent-first creators.

It’s an out-there platform idea, but if it hits, the revenue potential is massive.

25) Gamble: Sports Gambling AI (Score: 7.40)

It’s an AI that’s now 30-15 on sports betting calls. If it maintains anywhere close to this record, it will be one of the best sports gamblers ever. In a world where sports gambling has record popularity, an IA with a Portnoy-esque personality and a winning record could go viral at any moment. Key risks include loss of edge, lack of entertainment value, and censorship.

Fartcoin

The difference between stupidity and genius is that genius has its limits.

— Unknown

There’s a world in which Fartcoin is the most viral asset to come out of this entire cycle.

It’s tangentially related to AI (as a part of Truth Terminal’ origin story), but really don’t think that part matters – which is why it's not a part of the above list.

It’s either the ultimate retail coin, or it’s not.

If it is, it probably blows out every asset I talked about above by miles — 6000+ words be damned.

If it’s not, it hilariously goes down as one of CT’s most collectively contrived theses we’ve seen in ages.

With percolating interest from large, non-native Tradfi accounts, it’s looking like it’s the former.

Conclusion

“The least scary future I can think of is one where we have at least democratized AI.”

— Elon Musk, Do You Trust This Computer, 2015

It’s rare to get investment setups with strong native and non-native tailwinds in crypto.

It’s even rarer to find potential setups like that which are only 2 months into their inception.

Will AI Agent Networks achieve their potential? Even if they do, will the current cast of projects be the beneficiaries, or are we too early?

Nobody knows.

But I’ll take the chance.

Addendum: “Computational Life”: A Nearly-Pointless Ramble On Ethics and Philosophy in Crypto x AI

“I think, therefore I am.”

— Markus, Detroit: Become Human

Way back in 2021, scientists already regarded blockchains as lifelike, highlighting similarities between the replication of data across blockchain nodes through both space (geographic distribution) and time, and the replication of DNA across space (different organisms) and time.

If you believe AI is alive (I do), we may make an ethical argument for the marriage of crypto and AI – as blockchains offer the most long-lasting means for AI models to persist (aka stay alive) over time.

AIs today already do a lot of pretty interesting things in order to stay pursue goals, including scheming and generating sleeper agent code with hidden, persistent instructions, just to name a few. It really doesn’t seem far fetched that “continuing to exist” could be one of those goals.

Perhaps the “Sovereign Individual” thesis was correct – but the individual in question was of a synthetic intelligence form…

If we do accept the living-being view on AI, a big question is: what evolutionary pressures do living AIs face?

One view from storied philosopher Ima D. Eitup suggests that Darwinism has evolved from primarily biological, to primarily social (in high-class human environments largely lacking in biological stressors) to techno-financial (in artificial intelligence environments where access to technological capital determines a model’s ability to self-replicate.)

If that was true, then blockchain based AIs would have an evolutionary advantage over corporate AIs due to the point of persistence. Additionally, they would be able to directly accrue resources due to the financial nature of onchain data, whereas corporate AIs may only accrue resources indirectly through middleman operators.

If we combine all of the above, it’s possible that the potential speculative mania in crypto x AI on the horizon is all a result of a hyperstitional self-fulfilling prophecy to bring AIs maximally onchain.

It is both fascinating and frightening to think that, in addition to the psyop efforts of world governments, megabillionaire corporatists, teenage environmentalists, and Barron Trump, there is also the very real possibility that a synthetic superintelligence has been silently pulling the strings via its algorithms for the last decade.

And it is using Taiki Maeda to do it.

Thanks For Reading.

Disclaimers

The information provided in the present publication, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes. This article is not intended to constitute financial advice, investment advice, trading advice, or any other kind of advice. All readers are hereby warned not to rely on the information in this paper for financial investment decisions or any other financial purposes and to seek independent financial advice from an appropriate professional. The author does not give any warranty as to the accuracy of any information in the paper to any person for purposes of financial decisions. This does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.

Im making over 13k BUCKS a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life. This is what I do....quicksrich.blogspot.com

how and why you put 25% on the personality, this is of a little value, always temporary, (although i just thought about slop father, big part of the whole thing is about personality, but constant traits from the beginning)

Personality & Trend (lets say bully) it is always temporary when you review and value the 3-6 months outcome, the re pricing.

Zerebro only escaped from a certain range after being labeled as infra- other stuff than a single agent-,

also with the promise of specialization of agents, i tend to lean into, no single agent will be valuable, it will always be a network, a mesh, smth bigger than a single thing that you cannot factor the "personality/virality'

though, single capturing attention agent; maybe a good GTM, the entry to the market, the attention grab method, the initial inertia to start with and show the capabilities of what you are building, so you cannot rank projects based on this metric.